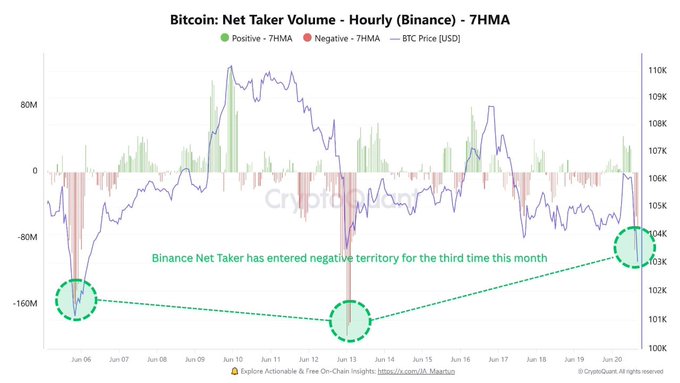

$160M in BTC Longs Wiped Out as Bitcoin Breaks Below $103K

Why did Bitcoin drop below $103,000 so suddenly?

How much in long positions was liquidated on Binance?

Will Bitcoin stabilize after this sudden drop?

- Bitcoin (BTC) Drops Sharply Below $103,000

- $160 Million Long Position Liquidation on Binance

[Unblock Media] Bitcoin (BTC) plummeted sharply below the critical support level of $103,000, leading to the liquidation of long positions on Binance, which saw the price drop to $102,500 within a few hours, according to data from CryptoQuant.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!