XRP Gets TradFi Stamp as TSX Launches First Spot ETF

What makes the Toronto Stock Exchange's new XRP ETF significant?

How did XRP's market performance change after the ETF approval in the US?

How are major global banks integrating cryptocurrencies like XRP?

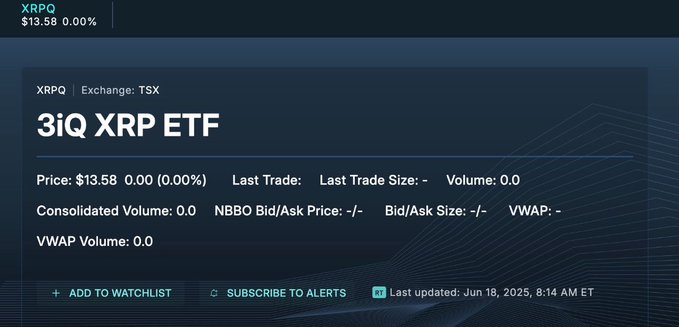

- Toronto Stock Exchange lists XRP-based Spot ETF

- Symbolizing the convergence between cryptocurrency markets and traditional finance

[Unblock Media]

On June 18, 2025, the Toronto Stock Exchange (TSX) in Canada listed the world's first spot ETF (Exchange-Traded Fund) based on Ripple (XRP). This listing is considered a significant milestone symbolizing the convergence between the cryptocurrency market and traditional finance.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!