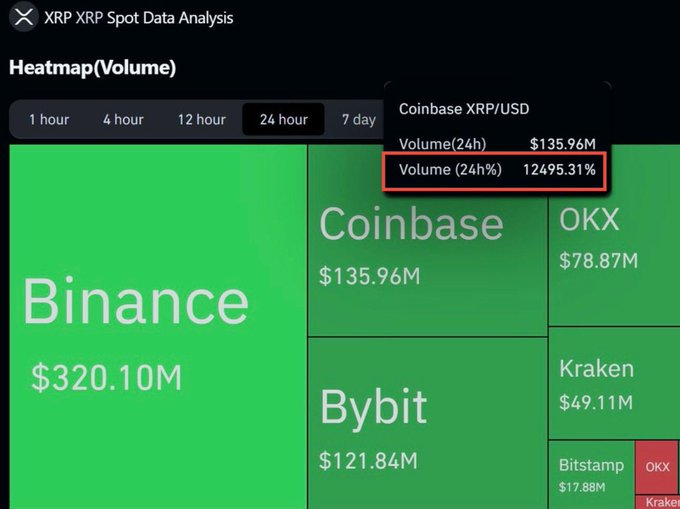

Whales or Hype? XRP Volume Soars 12,495% on Coinbase

Why did the trading volume of XRP on Coinbase surge by 12,495%?

What are the key factors behind the increased institutional interest in XRP?

How might the SEC's decision on the Franklin Templeton spot XRP ETF impact XRP trading?

- XRP trading volume surges 12,495.31% on Coinbase

- Approval of XRP ETF, increased institutional interest, and cross-chain integration

[Unblock Media] It has been reported that XRP trading volume has surged by 12,495.31% on Coinbase. According to data provided by prominent XRP community member Edward Farina (@Edward_Farina), this surge is the result of a combination of high expectations for the approval of a spot XRP ETF, increased institutional interest, and recent cross-chain integration efforts.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)

Get the latest news in your inbox!