- Issuance of $2.25 Billion Convertible Notes by GameStop, Expanded from Initial Plans in Two Days

- Purchase of 4,710 BTC, Worth $320 Million

[Unblock Media]

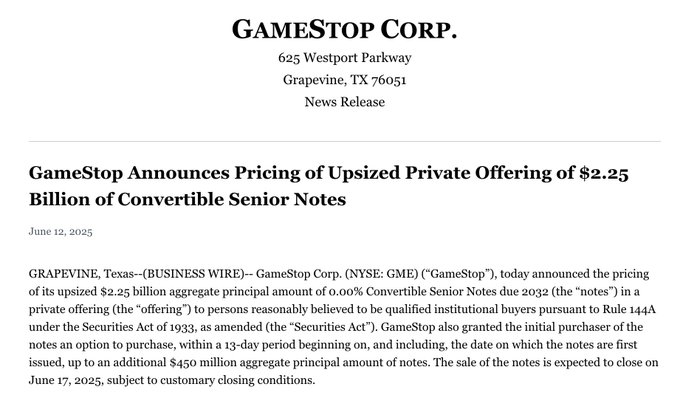

GameStop Corp. (NYSE: GME) is set to issue convertible notes amounting to $2.25 billion, increased from the initially announced $1.75 billion. Simultaneously, the company purchased approximately 4,710 BTC between May and early June 2025.

The convertible notes have a maturity date in 2029 and feature an interest rate of 3.5%. While this could enhance GameStop's short-term financial position, the potential stock dilution and interest burden could negatively affect share prices.

GameStop has stated that the funds from this issuance will be used for "general corporate purposes and strategic investments." However, it did not provide specific measures for addressing stock dilution or the burden of interest payments.

At the time of purchase, the 4,710 bitcoins were worth around $320 million. This move demonstrates a firm commitment to integrating digital assets into their asset strategy, akin to previous initiatives by companies like MicroStrategy, Tesla, and Block.

Bitcoin represents roughly 50% of the global digital asset market and has the largest market capitalization among cryptocurrencies. Notably, institutional investment has continued to rise since the U.S. Securities and Exchange Commission (SEC) approved the spot Bitcoin ETF.

GameStop's dual approach signals a turning point in the stock market, showcasing a strategic shift towards reducing reliance on traditional offline stores and increasing investment in digital infrastructure and asset diversification.

This can be seen as a continuation of the "Roaring Kitty" stock frenzy era but with a more institutional basis. Analysts believe GameStop's cryptocurrency strategy could be part of a long-term financial innovation, potentially including blockchain-based loyalty systems, tokenized rewards, or digital commerce integration.

GameStop's new direction brings both innovation and risks. While convertible notes provide immediate liquidity, failure in managing stock dilution or interest costs could undermine shareholder value. Additionally, exposure to Bitcoin introduces another layer of uncertainty.

Market analysts commented, "GameStop is walking a fine line between visionary transformation and speculative excess." It remains to be seen whether GameStop's strategy will lead to sustainable business changes or become another speculative venture.

Tags: GameStop, Bitcoin, Convertible Notes, Institutional Crypto Adoption, Strategic Finance, Treasury Management, GME, Digital Assets, SEC, Spot Bitcoin ETF