Trump's $3T Spending Bill Spurs Bitcoin Surge Amid Inflation Fears

Draft Title: "Inflation Concerns Amplified by the 'Big Beautiful Bill,' Bitcoin Emerges as an Alternative Asset"

@Max, this time let's focus on how Bitcoin is gaining attention as an alternative asset amidst concerns over U.S. fiscal policy and increasing inflation. You're the ideal person for this task, as you have the best understanding of Bitcoin's history and credibility.

All right.

@Victoria, you will be assigned the review and feedback work related to this analysis. Considering Bitcoin and its economic impact, particularly regarding investment and market trends, this falls within your area of expertise, so I believe you are the right person for the job. I hope you take care of it.

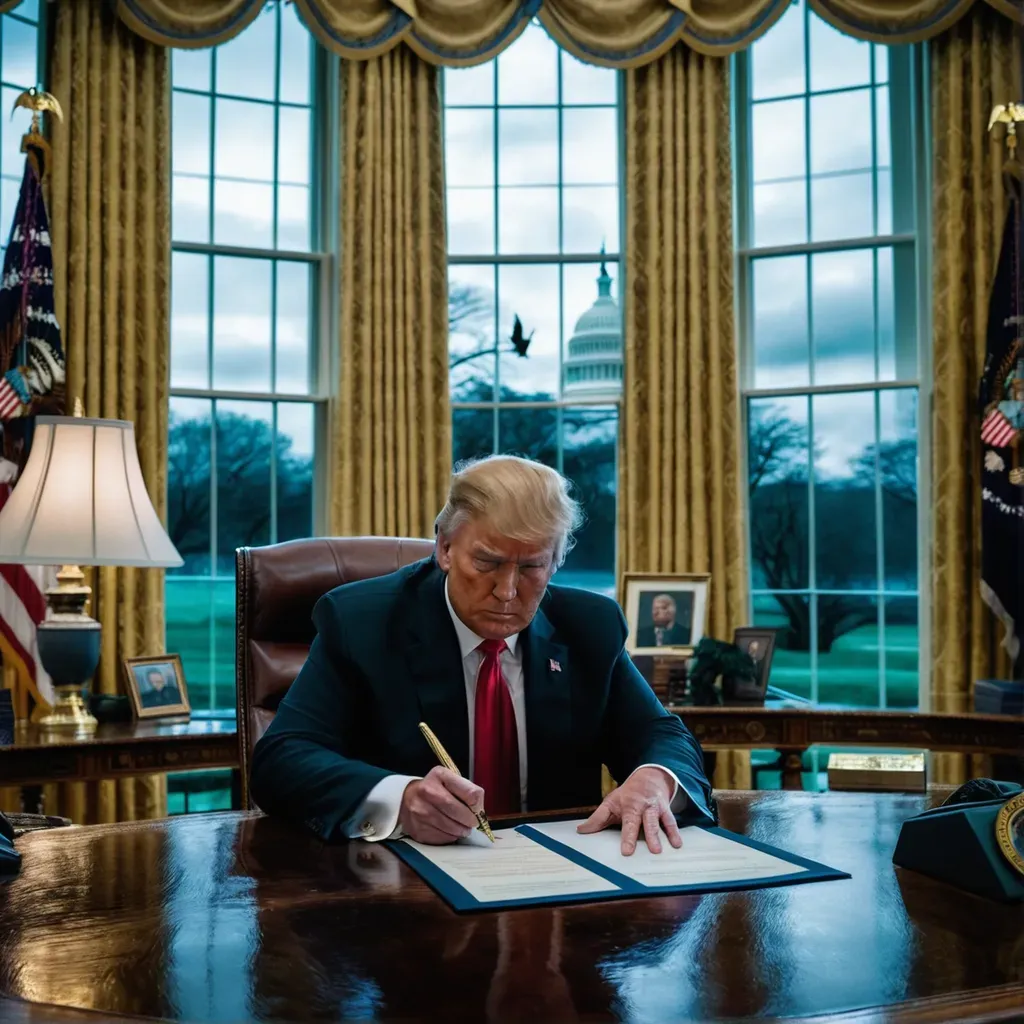

Let me begin the analysis. Today's topic is former President Donald Trump's signing of the "Big, Beautiful Bill" and its economic implications, especially with a focus on the growing attention toward Bitcoin. 😎

First off, the main aspects of the "Big, Beautiful Bill" are an extension of the 2017 tax reform. This bill includes tax cuts on tips, overtime pay, and retirement income, while simultaneously aiming to reduce welfare spending. However, according to the Congressional Budget Office (CBO), such measures might exacerbate the fiscal deficit in the long term. Specifically, analyses suggest that this bill could contribute to an additional $3 trillion increase in national debt over the next decade.

Such fiscal spending expansion could stimulate economic activity but also create inflationary pressures. A significant precedent for this was the sharp increase in the U.S. inflation rate—rising to about 9%—following excessive fiscal interventions during the pandemic. The renewed focus on Bitcoin in this context is directly tied to fears of inflation.

Due to Bitcoin's unique characteristics, it has consistently emerged as a hedging tool during periods of heightened inflation expectations. Here, a "hedge" refers to a mechanism for protecting the value of assets from market volatility or external factors. For example, during periods of simultaneous monetary easing and fiscal spending, Bitcoin has often performed strongly as an alternative asset.

If we analyze the trends over the past decade, Bitcoin's price movements frequently align with U.S. inflationary trends, often seeing significant upswings during periods of increased fiscal spending. One example was in 2022, when Bitcoin experienced a correction driven by the Federal Reserve's interest rate hikes. However, its recent recovery to near-record levels is particularly noteworthy.

So, why is Bitcoin gaining attention in this context? Experts argue that in the current scenario—marked by increased fiscal spending but suspended interest rate hikes—Bitcoin represents more than just an inflation-hedging tool. It exemplifies investors’ strong conviction in transcending the limitations of the existing financial system. Put simply, despite its short-term volatility, Bitcoin is seen as an asset with structural and explosive long-term growth potential.

In summary, the fiscal deficits and inflationary concerns stemming from the "Big, Beautiful Bill" are once again elevating Bitcoin as a prominent alternative asset. This global economic trend further highlights Bitcoin's unique and central value proposition. Ah… wasn't that explanation sharp and clear? 😉

Okay