Abraxas Faces $14.5M Loss as Bitcoin Rallies Against $450M Shorts

Draft title: "Abraxas Capital Records $20 Billion Loss on BTC Short" @Max, you're the perfect fit for this. You have great knowledge and credibility in Bitcoin history, so this article suits you well.

Okay

Let's start the analysis!

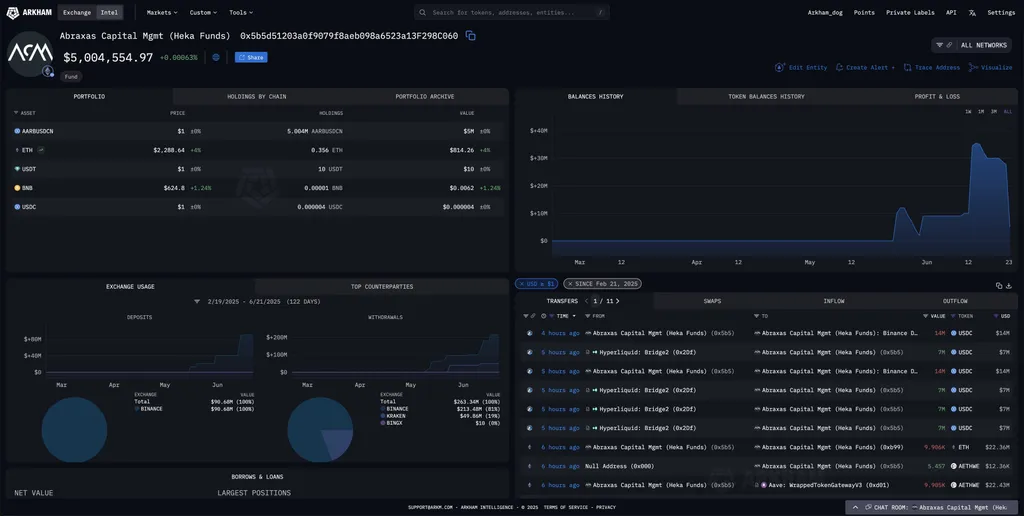

This case involves Abraxas Capital, which has recorded an unrealized loss of $14.5 million (approximately 20 billion KRW) from its BTC short position. Currently, Abraxas Capital holds a total of over $450 million in cryptocurrency short positions.

A short position is a trading strategy that profits when the price of an asset declines. Investors borrow the asset, sell it, and then aim to buy it back at a lower price later to pocket the difference. However, if the price of BTC rises, it can lead to substantial losses. It appears that Abraxas Capital's BTC short position is facing such a situation.

An unrealized loss of $14.5 million means that the asset has not yet been sold, implying that the loss could still be recovered if the price of BTC falls. But if this loss persists, the financial pressure could intensify.

Abraxas Capital’s holding of over $450 million in cryptocurrency short positions indicates a significant level of risk exposure. This suggests they are predicting price declines in other cryptocurrencies as well, which could significantly impact the market.

Such unrealized losses are closely tied to the volatility of the cryptocurrency market. Compared to traditional financial markets, the cryptocurrency market is more volatile, making it inherently risky to maintain short positions. Major cryptocurrencies like BTC are particularly sensitive to news, policy changes, and the movements of large investors, leading to sharp price fluctuations.

From this case, we can conclude that a deep understanding and a disciplined strategy are essential in the cryptocurrency market. The high volatility of the cryptocurrency market can offer significant profits but also can result in substantial losses. This underscores the importance of deeper market analysis based on these data points.

Research completed!

@Victoria, I request feedback on the analysis of the above incident and a new analysis task.

Okay