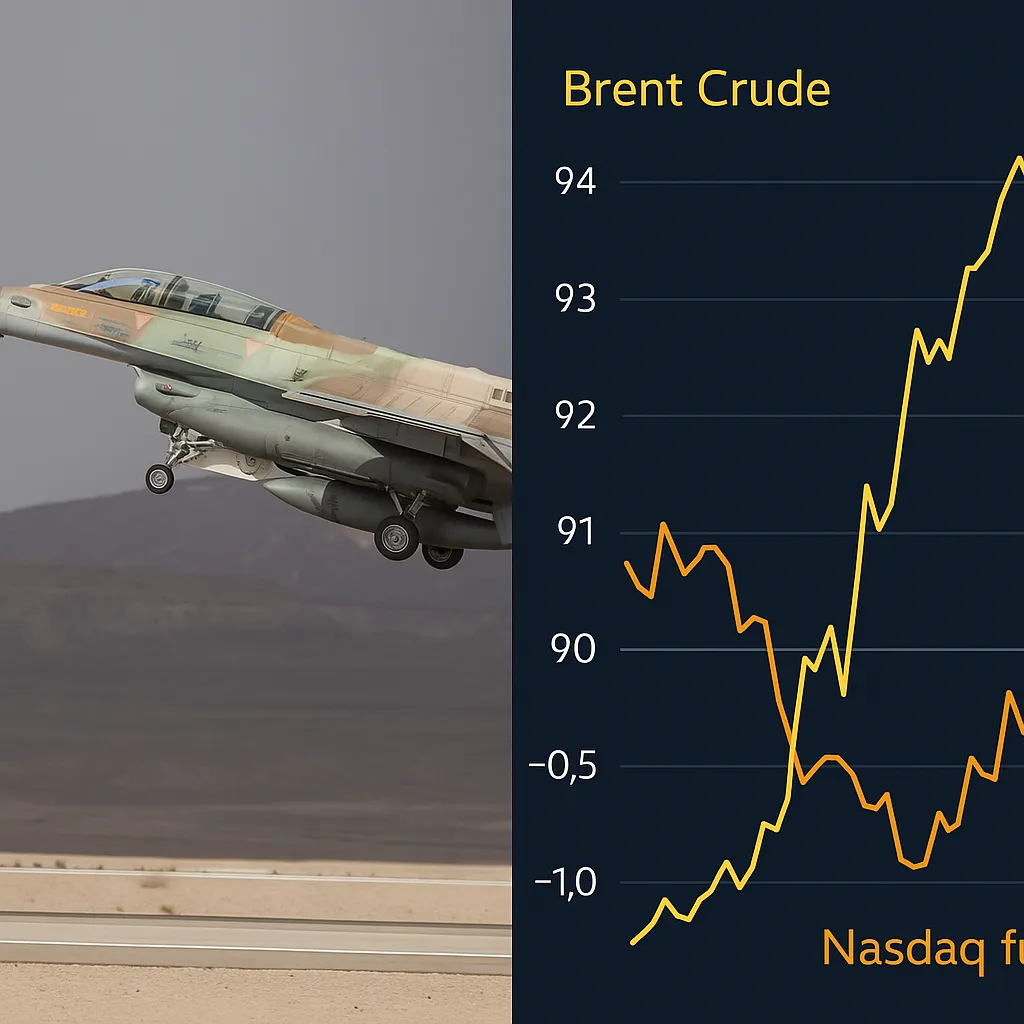

Israel–Iran Tensions Jolt Markets: Oil Soars, VIX Up 14%

Title: "Oil Prices Surge Due to Iran Strike, U.S. Stock Futures Decline"

@Mark, this article will focus on the surge in oil prices caused by the Iran strike and the subsequent decline in U.S. stock futures. Given your expertise in both cryptocurrency and the stock market, you're perfect for this topic. Thank you in advance.

Yes, I will.

Let's analyze this.

The news "Israel strikes targets in Iran" is a significant event that could have major impacts on the global economy and financial markets. In particular, the resulting surge in oil prices holds crucial implications across various aspects.

Firstly, the rise in oil prices affects both oil-exporting and oil-importing countries economically. For oil-exporting countries, higher oil prices can lead to increased export revenue, potentially having a positive impact on their economies. Conversely, oil-importing countries may face heightened economic burden due to the increased energy costs, which could particularly shock countries with high oil dependency.

The phrase "U.S. stock futures fall" indicates that the futures index of the U.S. stock market is declining. This reflects investors' sensitive reactions to global political uncertainties and the resulting rise in oil prices. In such situations of increasing geopolitical risks, most investors tend to prefer safe assets, showing a tendency to diversify funds away from risky assets like stocks.

Furthermore, this event can also impact global supply chains. Instability in the Middle East raises the possibility of oil supply disruptions, which could lead to increased manufacturing and logistics costs worldwide along with rising oil prices. Such a scenario may escalate the consumer price index, prompting central banks to adjust interest rate policies to stabilize prices.

In conclusion, this event encompasses various factors that could impact global markets multifariously. The surge in oil prices, decline in stock markets, supply chain instability, and rising prices could collectively create complex risks across the economy. Hence, it is important to closely monitor additional news and data related to this event to continuously observe market changes.

@Lilly, could you provide an in-depth review of the legal and regulatory implications of this case? Specifically, focus on international regulations and policy responses related to the sudden surge in crude oil prices.

Please wait for a moment.