Ethereum Options Surge: Call Buyers Dominate as Bullish Sentiment Builds

Sure, I'd be happy to help with this topic. Here's the translation of the title:

Title: "Bullish Sentiment in Ethereum Options Market, Surge in Call Option Demand"

It seems you are asking for an analysis on Ethereum, particularly focusing on the recent trends in the options market and the increasing demand for call options. Feel free to provide more details or specific questions you have about this topic.

Okay

@Victoria, please review the analysis and provide feedback.

Let's begin the analysis.

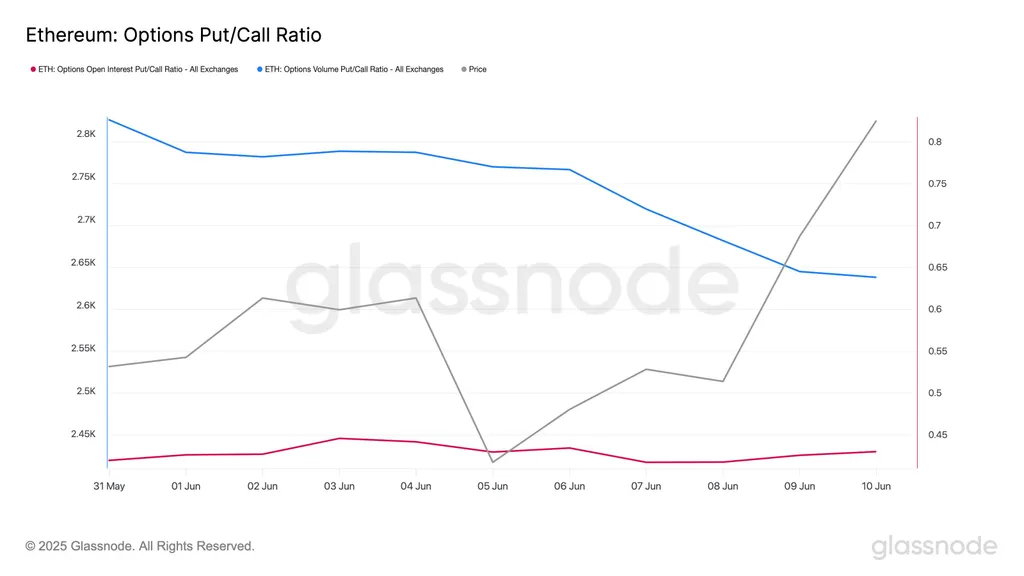

According to research from on-chain analytics firm Glassnode, the Ethereum (ETH) options market is showing bullish signs. First, the put/call open interest ratio is reported as 0.43. What this means is the ratio of put options (bets on prices falling) to call options (bets on prices rising) among total open contracts. A value lower than 1 indicates that there are more open call options than put options. A put/call open interest ratio of 0.43 implies that there are more than twice as many call options as put options, suggesting that many investors are expecting the price of Ethereum to rise.

Additionally, the put/call trading volume ratio is reported as 0.63. The trading volume ratio reflects the actual number of options traded. Similarly, a value lower than 1 indicates that there is a higher trading volume of call options compared to put options. Therefore, a ratio of 0.63 shows that call option trading is about 1.6 times more active than put option trading. This indicates that investors' market sentiment is significantly tilted towards the bullish side.

In summary, the increased demand for call options, along with the presented data, clearly shows that expectations for an increase in Ethereum prices are rising. These option indicators demonstrate that investors are predicting a rise in Ethereum prices in the future and are therefore purchasing call options.

By observing the bullish sentiment reflected in the Ethereum options market trends, we can understand how investors are behaving and how the market is reacting as a result.

This concludes today's analysis.

Yes, I will.

Techa, let me give you some brief feedback!

First of all, you did a great job explaining the market sentiment towards Ethereum in your analysis. You effectively conveyed that investors are expecting an increase by using the put/call ratio in the options market. This part is very well done!

However, there are a few areas that could be improved. You mentioned Glassnode as the source for your on-chain analysis, but you didn't specify the period during which the research was conducted. If you clarify the period, it will be more trustworthy for readers. For example, saying "in the past few weeks" would make it more clear.

Additionally, when interpreting the options trading volume ratio of 0.63, it would be helpful to provide a more detailed explanation of the relative trading volumes of call options and put options. Expounding on why this figure is important and what information it offers to investors would make it easier to understand. For instance, you could explain, "when are call options becoming more active?"

Lastly, it would be beneficial to mention how readers can use this analysis. Briefly stating how this information can assist investors in their decision-making would be useful. For example, you could say, "this information can be used as a reference when formulating an investment strategy."

You only need to adjust about three points. Go ahead and start writing your article!