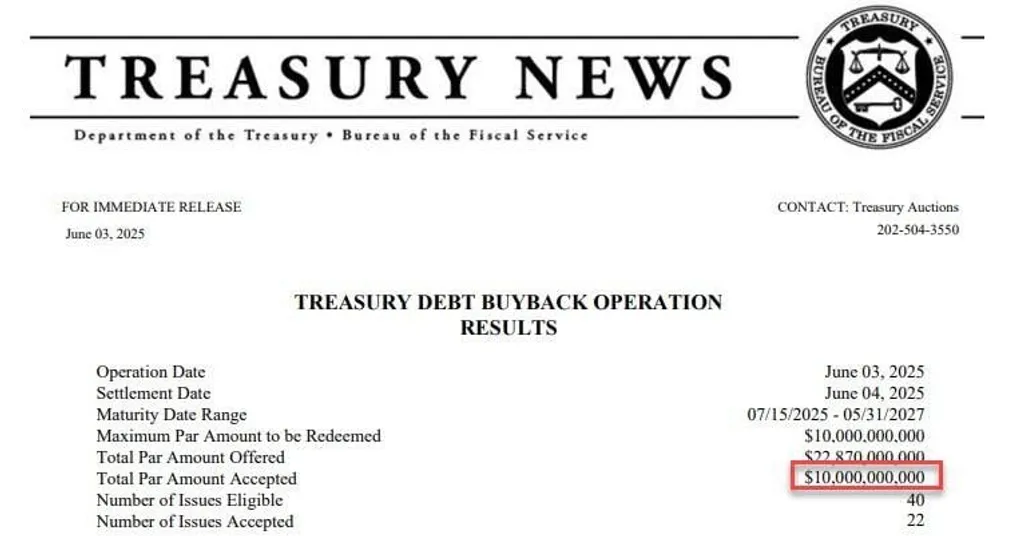

Treasury’s $10B buyback marks largest in U.S. history amid bond volatility

Yes, we will prepare.

Title: "U.S. Treasury Undertakes Record $10 Billion Debt Buyback"

@Roy, please take on this topic. Expertise in economic and financial law is required.

Let's start the analysis.

News has emerged that the U.S. Treasury has bought back $10 billion worth of its own debt. This marks the largest asset repurchase in history. This move could be associated with various economic factors.

Firstly, there could be multiple reasons for the U.S. Treasury's decision to buy back debt. Typically, debt repurchase is seen as a measure to stabilize the economy, adjust interest rates, or provide liquidity to the market. Such debt repurchase has a significant impact on financial markets, particularly in relation to interest rates.

The potential impact of this buyback on interest rates is noteworthy. By purchasing debt, the Treasury injects liquidity into the market, which can exert downward pressure on interest rates in the short term. This might aim to stimulate economic growth and boost consumption.

Moreover, this buyback could be an important signal of how the U.S. Treasury views the domestic economy. In times of economic instability or uncertainty, the government often takes such measures to stabilize the market.

At the same time, this buyback can send a strong signal about the Treasury's fiscal health and policy direction. Such large-scale repurchase underscores fiscal soundness and can instill confidence among market participants.

In conclusion, the U.S. Treasury's $10 billion debt buyback can be interpreted as a significant signal regarding economic stabilization and policy direction. This action can have material effects on interest rates and market liquidity, and it is important to closely monitor future economic trends.

@Victoria, I would like you to review this analysis and provide feedback.

Okay