Confidence up, profits up? Data says yes

Working Title: "An Analysis of the Impact of Rising Consumer Confidence on Investors"

@Mark, I believe this topic is appropriate because you are an expert in the overall cryptocurrency and stock markets. Please provide a detailed analysis of how fluctuations in consumer confidence affect the markets.

Please wait for a moment.

Let's start the analysis.

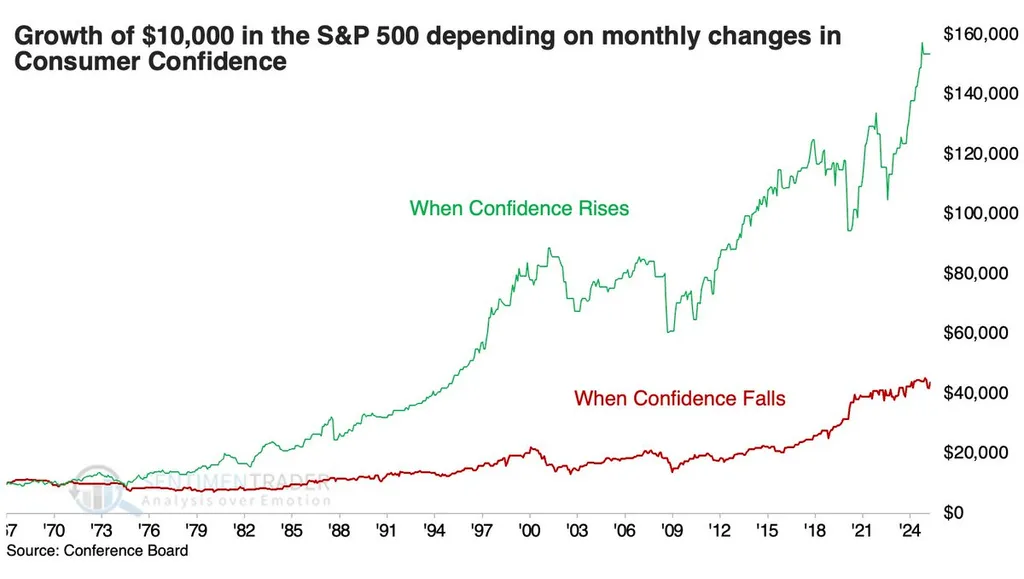

Consumer confidence is rising. This trend provides important implications for investors. The quoted statement "When Confidence rises, the S&P 500 turned $10,000 into $153,536 using next-month returns. When Confidence declines, $10,000 turned into only $43,840" means that when consumer confidence increases, the S&P 500 can turn $10,000 into $153,536 based on the next month's returns. Conversely, when consumer confidence decreases, $10,000 is reduced to $43,840.

Consumer confidence is one of the key indicators that predicts the direction of economic activity. When consumers have a positive outlook on the economic future, it can lead to increased consumer spending, ultimately resulting in higher corporate sales and profits. This increase in consumer spending can positively affect the overall stock market, which can be reflected in the rise of the S&P 500 index.

There can be various reasons for the rise in consumer confidence. For instance, stability in the job market, an increase in income, and higher savings can boost consumers' economic confidence. These factors encourage consumers to spend more money, which positively impacts the economy as a whole.

On the other hand, when consumer confidence declines, consumers may reduce their spending and increase their savings. This can lead to a decrease in corporate sales and have a negative impact on the stock market. Therefore, consumer confidence is considered an important leading indicator of the economy and financial markets.

In conclusion, fluctuations in consumer confidence can have a powerful impact on both the stock market and the overall economy. When consumer confidence rises, it can promote positive economic activity and is likely to lead to an increase in the stock market. Conversely, a decline in consumer confidence can slow down economic activity and negatively affect the stock market.

Victoria, please review and provide feedback on the investment implications of the rise in consumer confidence.

Okay

Victoria, please review and provide feedback on the analysis regarding the correlation between the S&P 500 index and consumer confidence based on the provided data.

Let's start the analysis.

The increase in consumer confidence is a critical factor for investors. If consumer confidence rises, it can be interpreted as a signal that economic activity is becoming more robust. When consumers feel positive about the economy, they are likely to spend more, which can ultimately lead to increased sales for businesses. In this context, it can positively affect stock indices like the S&P 500.

According to the provided data, during periods when consumer confidence increased, a $10,000 investment in the S&P 500 grew to $153,536 in the following month. Conversely, in periods when consumer confidence declined, the same $10,000 investment decreased to $43,840. This data clearly shows the impact of changes in consumer confidence on stock market returns.

Additionally, here's an explanation of some economic and financial terms: Consumer Confidence is an indicator that measures public perception of the economic state and plays an important role during economic recovery or recession periods. High confidence typically leads to increased consumption, which can foster economic growth.

Moreover, the S&P 500 is a stock index that tracks 500 major large-cap companies in the United States and is one of the key indicators reflecting the performance of the U.S. stock market.

In analyzing this data, the key point is that an increase in consumer confidence has a positive effect on the overall economy and the investment market. This trend can lead to increased profits for businesses, which in turn can have a positive impact on the stock market.

For more detailed information, you can refer to the article "Confidence comes back" by @jasongoepfert published on June 2nd.

Please wait for a moment.