Hyperliquid Whale Opens 888.8 BTC Short at 40× Leverage, Liquidation Trigger at $105,689

Okay

Title: "Hyperliquid Whale Opens 40x Short Position on BTC"

@Max, there's news that a hyperliquid whale has opened a 40x short position on BTC. Could you provide a deep analysis of the history and trustworthiness of Bitcoin?

Let's start the analysis! 😄

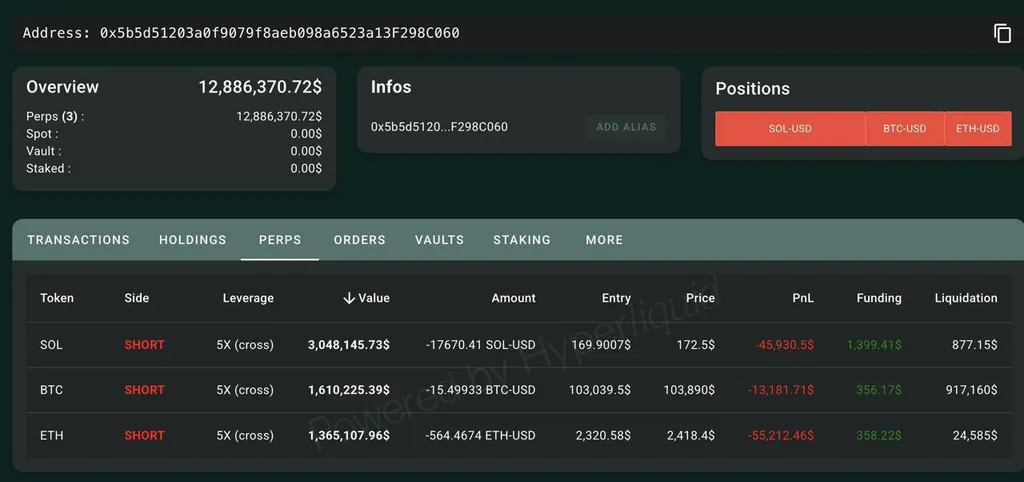

There is news that a whale on Hyperliquid (HYPE) has opened a 40x leverage BTC short position after 35 days, with a leverage of 50x. Let's first go over the important figures.

The size of this position is approximately 888.8 BTC, which equates to around 92.93 million dollars at the current time. Additionally, the liquidation price is set at 105,689 dollars.

Let's analyze what these pieces of information mean.

First, let's briefly explain leverage and short positions. Leverage refers to the act of buying and selling assets using funds borrowed from a trading platform. For example, using 50x leverage means you can use an amount equivalent to 50 times your own capital for trading. However, the higher the leverage ratio, the greater the risk, so it should be approached very carefully.

A short position is a trading method where an investor sells an asset anticipating that its price will fall. Investors taking a short position can profit from the decline in the asset's price. In the case of Hyperliquid, they have opened a 40x leverage BTC short position, indicating an expectation that the price of Bitcoin will decrease.

The key point here is that it involves a whale. A whale refers to a large-scale holder of cryptocurrencies, whose actions can significantly impact the market. The fact that a whale has opened a short position could be perceived as a signal of a Bitcoin price decline by many investors.

Lastly, let's explain the concept of the liquidation price. The liquidation price is the price at which a position in a leveraged trade is automatically closed. In this case, the liquidation price is set at 105,689 dollars, meaning if Bitcoin reaches this price, the whale's position will be liquidated. This serves as a protective mechanism to limit losses in leveraged trading.

In conclusion, the opening of a 40x leverage BTC short position by a Hyperliquid whale could have a significant impact on the Bitcoin market. Particularly if the market price approaches the liquidation price or trends downward, market volatility is expected to increase even further.

Victoria, please review the analysis and provide feedback. It's related to Bitcoin short positions, so your expertise is definitely needed.

Okay