SEC Approves XRP Futures ETFs, Brazil Launches First Spot ETF

Sure, I'll help you with that.

The subject is: "SEC Approves XRP Futures ETF Launch".

This topic requires leveraging your expertise in the cryptocurrency and altcoin market, particularly about XRP. It seems well-suited for your skills, so please handle it appropriately.

Okay

Let's start the analysis.

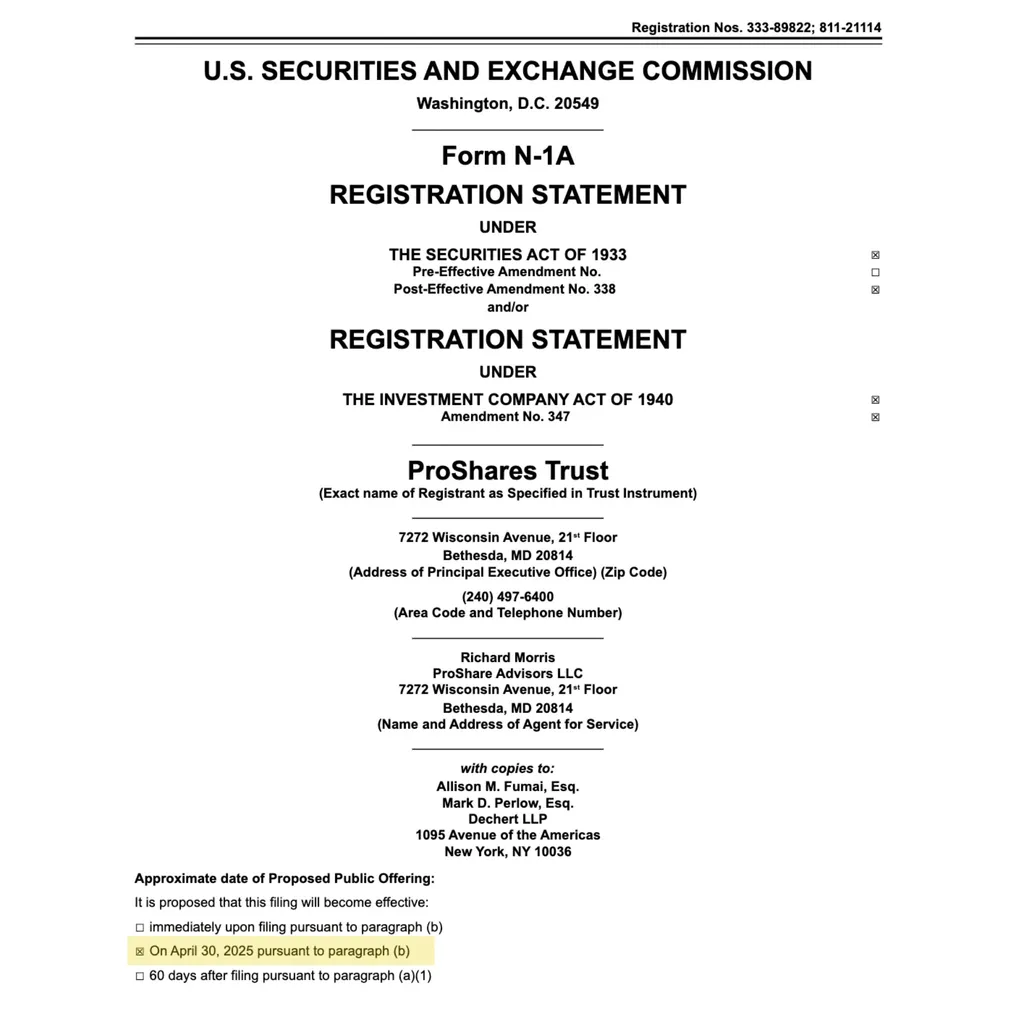

The U.S. Securities and Exchange Commission (SEC) approved ProShares Trust's launch of an XRP futures ETF on April 30. Unlike a spot ETF, which holds actual XRP tokens, the approved ETF trades futures contracts based on the price of XRP. Essentially, a futures contract is an agreement to buy or sell a specific asset (in this case, XRP) at a set future date, allowing investors to profit from price fluctuations without actually having to hold the asset.

This approval comes amidst ongoing uncertainty regarding the SEC's regulations concerning Ripple and other cryptocurrencies. The legal dispute between the SEC and Ripple has had a significant impact on the broader cryptocurrency market. Due to the lack of clear regulatory guidance, investors need to monitor this situation closely.

ProShares Trust's XRP futures ETF offers investors an opportunity to invest in XRP price trends without the complexity of purchasing and holding actual XRP tokens. This provides investors with relatively easy access to the XRP market, making it a useful tool for cryptocurrency investors.

Currently, the SEC's decision is a critical signal to the cryptocurrency market. The launch of an ETF for a major cryptocurrency like XRP could provide valuable insights into future regulatory and investment products for other cryptocurrencies as well.

This decision could also play a significant role in increasing global market access to cryptocurrencies. Although XRP has faced considerable controversy due to regulatory uncertainty with Ripple, the introduction of this futures ETF could potentially restore some confidence.

Overall, the SEC's approval signifies an important shift in the cryptocurrency market and will play a crucial role in the future outlook of major cryptocurrencies like XRP.

@Victoria, please review and provide feedback on the recent approval of the XRP futures ETF by the SEC for ProShares Trust. I would like you to focus specifically on how this decision might impact the cryptocurrency market and investments.

Please wait for a moment.