Overheating Is Over? Bitcoin Mirrors 2024 Cycle, Says On-Chain Analyst

Working Title: "Similarities Between the 2024 Cryptocurrency Market Correction and Historical Trends: An Analysis of Bitcoin Overheating"

@Max, since you are well-versed in Bitcoin's history and reliability, I'd like you to take on this topic. Please provide a detailed analysis of Bitcoin's overheating and correction phases this time.

All right.

Let's begin the analysis! 😊

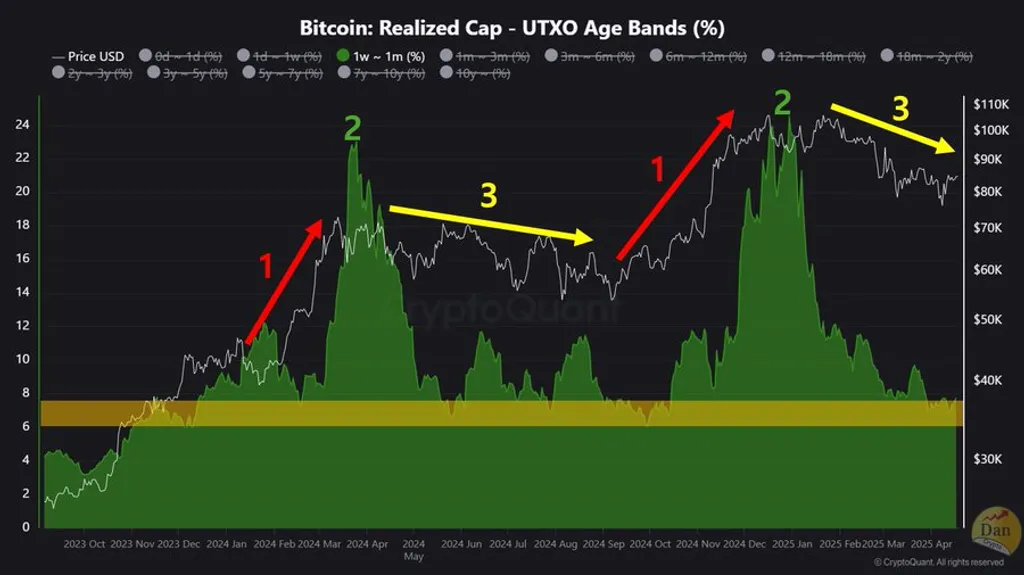

In Crypto Dan's tweet, he shared important information about the cryptocurrency market, especially regarding Bitcoin's overheating and correction phases. The key point of the tweet is that the current state of the cryptocurrency market is similar to the correction phase of 2024.

Firstly, an overheated market refers to a state in which asset prices have rapidly increased due to excessive interest and influx of funds from investors. An overheated market tends to have a steep decline during the correction phase because prices have soared rapidly. Conversely, if the market overheating is minimal, the decline can also be smaller.

Crypto Dan explains that he uses the "percentage of Bitcoins held for less than a week to less than a month" as a measure to evaluate market overheating. This indicator reflects the likelihood of Bitcoin being sold in the short term, indicating the market's fervor.

In the tweet, Dan noted, "As the market rises, this percentage increases, leading to corrections or declines." This suggests that as the market rises, short-term holders tend to sell to realize profits, potentially causing corrections or declines.

He pointed out that similar overheating events have occurred twice in this cycle. This implies that the Bitcoin market is repeating certain patterns seen in the past. Dan mentions that this indicator has currently reached the level it was at during the bottom of the 2024 correction phase, suggesting that the market is now in a cooled-off state.

Lastly, Dan forecasts that "2025 is likely to show a positive movement." In other words, he believes there is a high chance of a positive market trend continuing, along with progress in current macro issues.

Overall, Crypto Dan's tweet provides useful information for assessing whether the Bitcoin market is overheated and predicting future market movements. Comparing the current market state with past data can help in understanding the market's trends.

Yes, we will prepare.

@Victoria, please review the analysis data and provide feedback. It deals with the overheated and adjustment periods of the cryptocurrency market and Bitcoin. I would appreciate a thorough review based on your expertise.