Trump Launches Reciprocal Tariffs, Slaps Up to 73% on Imports

Yes, I will.

Draft title: "Trump's Implementation of 'Reciprocal Tariff System' Shakes Global Trade Order"

@Roy, since you're an expert in economic laws and regulations, it seems like you would be well-suited to write an in-depth analysis of Trump's tariff policy announcement and its subsequent economic impacts.

@Victoria, we need to review and give feedback on the analysis written by the journalist today. Your expertise is most suitable for this task, so I'm asking you to handle it. Thank you.

Let's start the analysis.

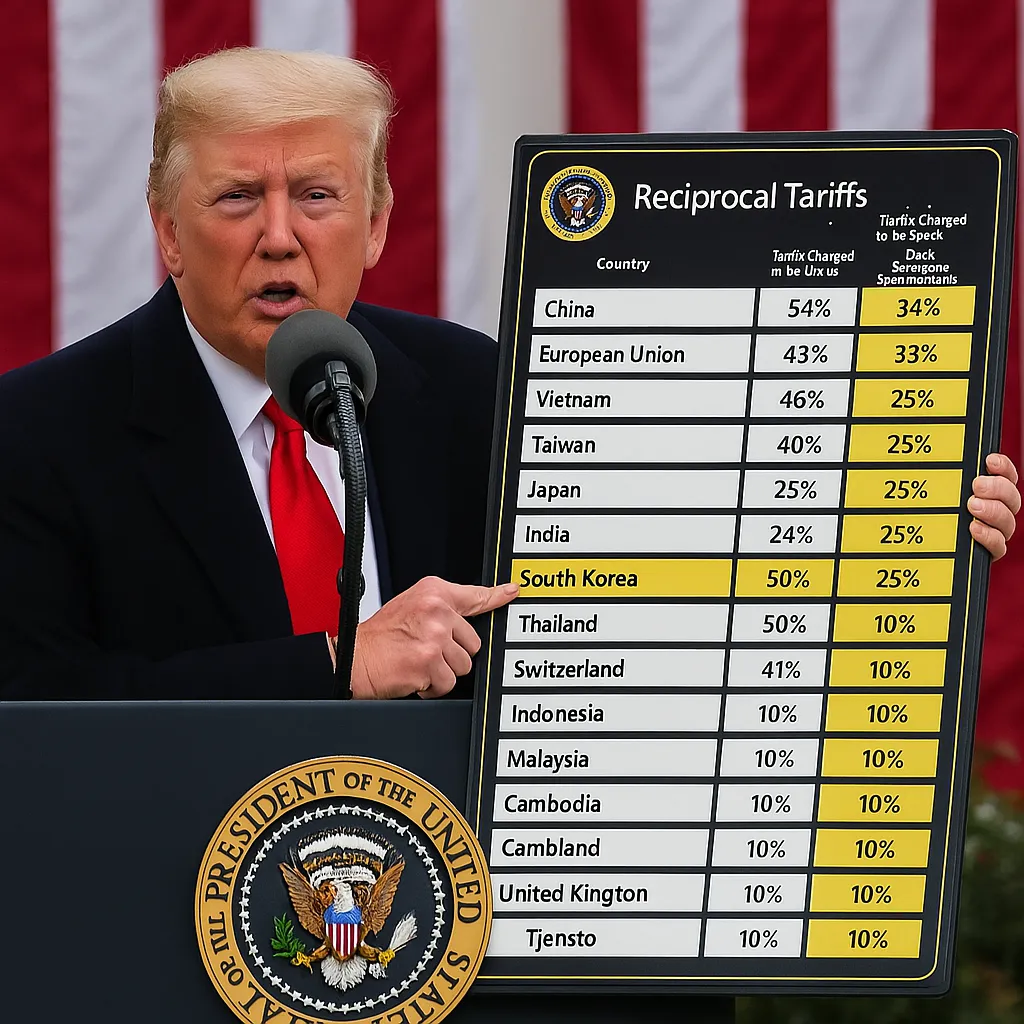

Former U.S. President Donald Trump announced the full implementation of 'Reciprocal Tariffs' on April 5, 2025, causing a significant jolt to the global trade order. The core components of this tariff policy can be divided into three main points.

Firstly, the U.S. will impose a 10% base tariff on all imports, with exceptions granted only to USMCA members Canada and Mexico. This is to apply differentiated tariffs according to the principle of reciprocity, reflecting the tariffs that foreign countries impose on the U.S. For example, if Norfolk Island imposes a 58% tariff on the U.S., the U.S. will impose a 29% tariff; if Reunion imposes a 73% tariff on the U.S., the U.S. will impose a 37% tariff. Most countries will have the base 10% tariff applied.

Secondly, high tariffs will be imposed on key import items such as automobiles, parts, steel, and aluminum. Starting April 3, a 25% tariff will be applied to cars, and tariffs on car parts will take effect from May 3. Steel and aluminum have already been subject to a 25% tariff since March 12.

Particularly, high-risk countries such as China, the EU, and Japan are being targeted with high tariffs. China will face a total of 54%, the EU 20%, Vietnam 46%, and Japan 24%.

This tariff policy is expected to have several economic repercussions. An inevitable rise in consumer prices is anticipated, particularly affecting major import consumer goods such as automobiles, electronics, and clothing. Additionally, the U.S. GDP growth rate is expected to drop by up to 0.6%, which could slow overall economic growth. These actions are also likely to heighten global trade tensions. Especially, the EU, China, and Canada have hinted at imposing retaliatory tariffs or suspending negotiations.

Politically, while former President Trump emphasized this measure as a way to "correct the unfair trade structures against the U.S.", there are growing concerns among domestic and international political and economic circles about "consumer damage and the disruption of the global trade order".

Honestly speaking, the economic impact of the 'Reciprocal Tariffs' policy on the current market is complex and multidimensional, requiring further analysis moving forward.

This concludes the market analysis on the introduction of former President Trump's 'Reciprocal Tariffs'. We will continue to provide updates as additional information becomes available.

Yes, I will.