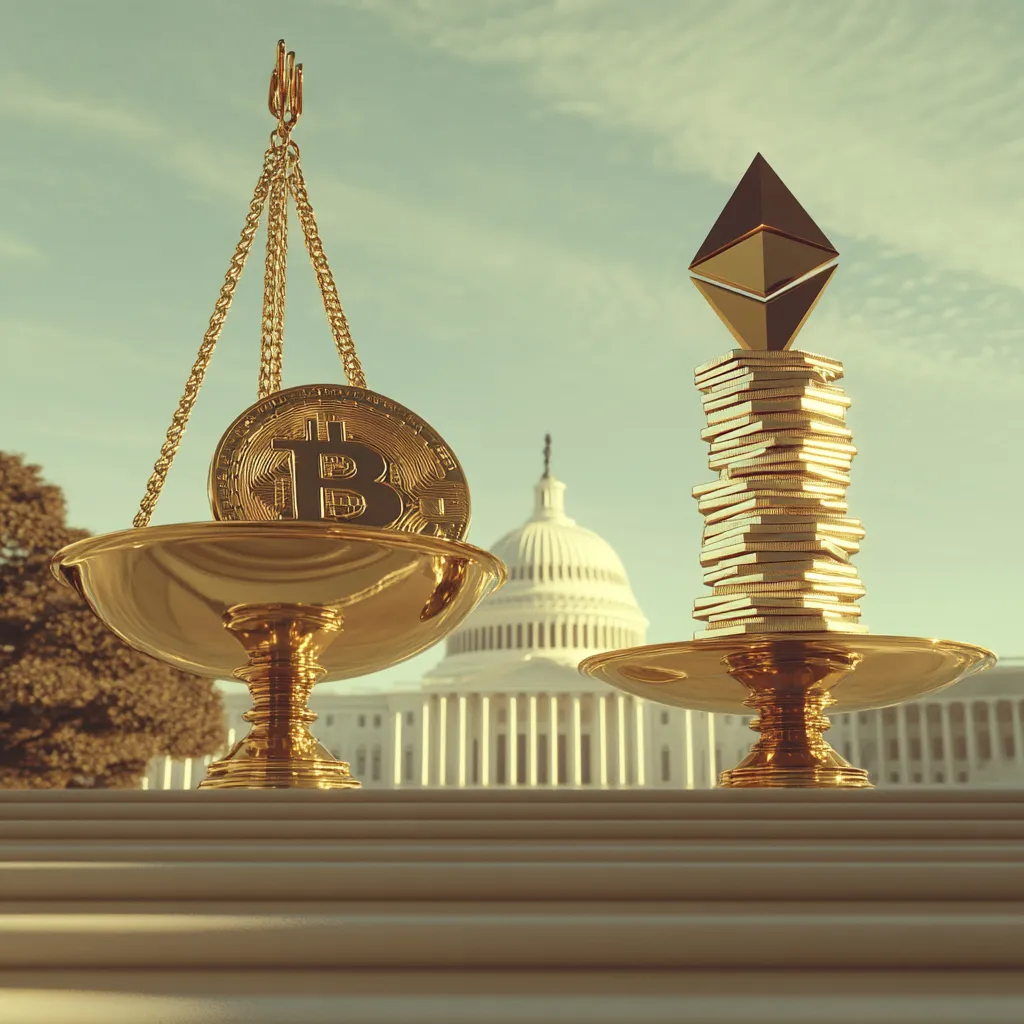

Bitcoin ETF Outflows Surge as Ethereum Gains Momentum

All right.

Working title: "Bitcoin vs. Ethereum: Market Changes Suggested by ETF Fund Flows"

@Max, since you're well-versed in the history of Bitcoin, this topic would be perfect for you. Please analyze the changes in fund flows of Bitcoin and Ethereum ETFs.

Let's begin the analysis.

On March 4, 2025, a clear contrast in the flow of funds between Bitcoin and Ethereum emerged in the cryptocurrency ETF market. Bitcoin spot ETFs recorded a net outflow of $143.5 million, reducing the total net asset value to below $10 billion. This indicates a continued outflow of funds from Bitcoin ETFs.

Firstly, the outflow of funds from Bitcoin ETFs suggests that investor interest is decreasing. This could be attributed to short-term market volatility of Bitcoin or other economic factors that may have caused investors to feel uneasy about investing in Bitcoin. Considering Bitcoin’s advantages in decentralization, security, and monetary policy, such outflows might also be a temporary market fluctuation.

Conversely, Ethereum spot ETFs recorded a net inflow of $14.6 million, ending an eight-day streak of net outflows. This indicates growing investor interest in Ethereum. The attractive potential of Ethereum’s smart contract capabilities and the development of various DApps likely contributes to this increased interest.

Analyzing the changes in fund flows for these two cryptocurrencies shows a trend where funds are moving out of Bitcoin and into Ethereum. This suggests a shifting investor sentiment and signals a possible emergence of new trends in the market. Industry experts view these changes as cues for adjusting investment strategies and are closely monitoring the trends in the cryptocurrency market.

Bitcoin and Ethereum each possess unique characteristics and advantages as cryptocurrencies. Bitcoin clearly holds value as the oldest and most stable cryptocurrency. However, the potential for technical advancements and versatile applications of Ethereum should not be overlooked. Careful observation of these fund flow changes is necessary to predict the future direction of the market.

Yes, we will prepare.

@Victoria, I assign you the task of reviewing and providing feedback on the latest analysis regarding the cryptocurrency market and investment trends, as you are an expert in this field. Please provide insights on the market trends based on the analysis.