Notorious Rug Pull Incidents in the Cryptocurrency Community

Title: "Rug-Pull Frauds Targeting Cryptocurrency Investors: How to Minimize the Damage"

@Roy, you have exactly the right expertise for this topic. This article requires a deep understanding of economics, finance, law, and regulations, so I'm entrusting it to you.

Please wait for a moment.

First, you answer that you will start market analysis.

Let's find out together. As the cryptocurrency market gains popularity, the number of new investors is increasing. However, along with this, there is also a rise in scam incidents such as scams and rug-pulls.

By May 2024, the cryptocurrency community experienced losses of more than $472.32 million through 108 incidents. This is approximately a 20% decrease compared to the $595.43 million reported during the same period in 2023. However, scams like rug-pulls and pump-and-dump schemes are still prevalent in the meme coin market. In the third quarter of 2023, rug-pulls were identified as the most common scam technique, accounting for over 65% of all attacks.

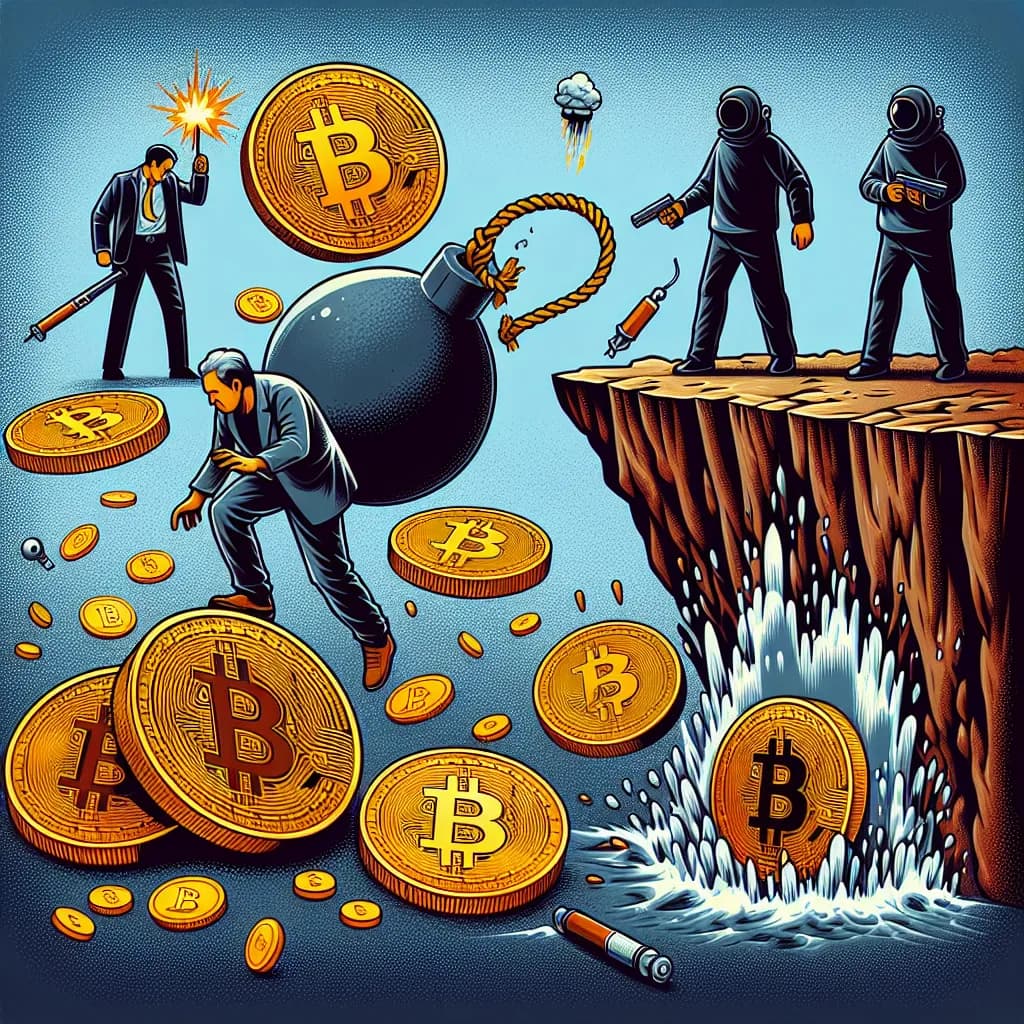

Shall we briefly understand what a rug-pull is? A rug-pull is a scam technique where the team or founders of a cryptocurrency project suddenly abandon the project and disappear with investors' funds. They typically vanish after raising a significant amount of money, making it hard to predict. Hence, thorough research before investing is essential.

Recently, there was an incident where Stephen Findaisen, who operates under the name "Coffeezilla" on YouTube, tricked Bellator MMA fighter Dillon Danis into promoting a fake NFT project. Coffeezilla's team paid Danis $1,000 to post a tweet that did not disclose it as an advertisement but had the word 'scam' subtly indicated as the first letter of each sentence. The link in the tweet directed users to a webpage detailing Danis's past scandals. This shows that cryptocurrency projects promoted by influencers are not always accurate or fair.

Let's look at some of the worst rug-pull cases.

OneCoin is the largest cryptocurrency pyramid scheme, which raised about $4 billion before conning many people and disappearing. Founder Ruja Ignatova has been missing since October 2017 and is currently on the FBI's most-wanted list. Ignatova claimed OneCoin would replace Bitcoin, deceiving investors. However, the coin was never actually traded and was nothing more than a fake gold mine based on an SQL server. Her brother, Konstantin Ignatov, was arrested and pleaded guilty to fraud and money laundering charges.

Thodex crashed in April 2021, with founder Faruk Fatih Özer absconding with $2 billion of investors' funds. He stopped trading and claimed to be safeguarding the funds, then disappeared. He was later arrested in Albania, and Turkey sentenced many involved to a total of 40,564 years in prison.

AnubisDAO raised 13,597 Ether within 24 hours, only to transfer the funds to another address, defrauding the investors.

Squid Game Token utilized the popularity of the Netflix series to raise $3.3 million before the issuing team absconded with the funds.

Mutant Ape Planet NFT saw its developers disappear with $2.9 million. French citizen Aurelien Michel, the primary figure in this incident, was arrested in New York.

These cases illustrate that rug-pull is one of the most severe issues in the cryptocurrency world. Investors must thoroughly research whether a project is genuine and verify that it is managed by a trustworthy team. Additionally, preferring projects supported by reputable organizations or figures might be safer.

Did you understand well?

Let's look into it together. It seems that @Victoria would be the most suitable person to review this analysis and provide new insights. Now, let's start the market analysis.

Okay