- Cryptocurrency investment firm Abraxas Capital incurs a loss of approximately $14.5 million from Bitcoin short positions.

- Bitcoin price surge influenced by the repeal of U.S. IRS regulations and the approval of Bitcoin spot ETFs.

[Unblock Media]

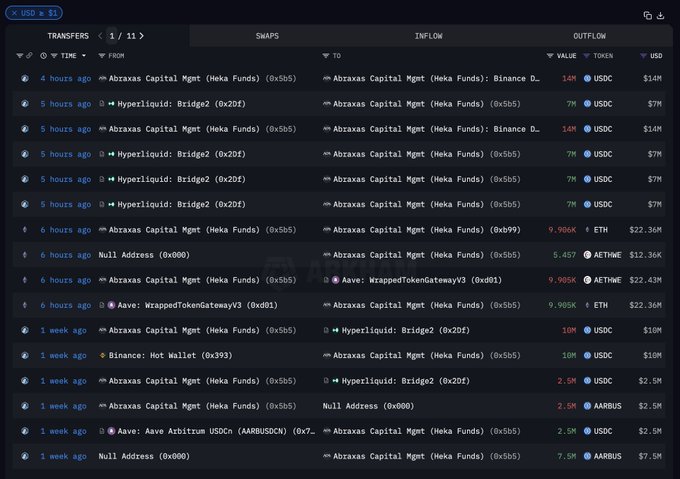

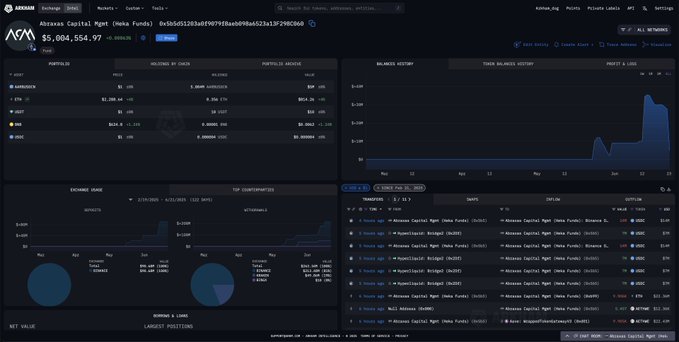

Cryptocurrency-focused investment firm Abraxas Capital has recorded an unrealized loss of approximately $14.5 million (about 20 billion KRW) from its Bitcoin (BTC) short positions. According to the on-chain analysis platform Arkham, the address currently maintains short positions in cryptocurrencies worth more than $450 million.

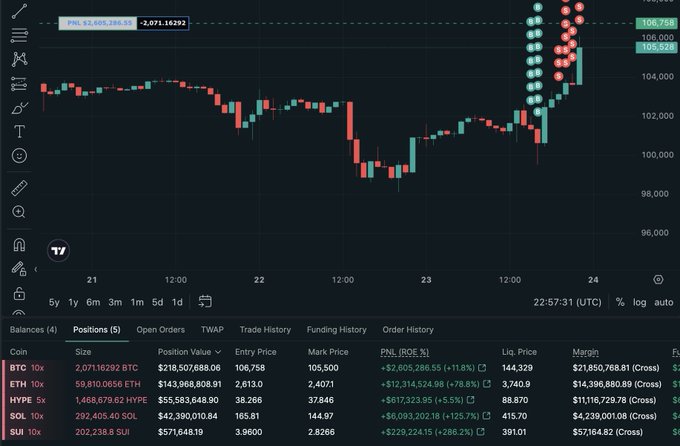

A short position is a trading strategy aimed at profiting from a fall in asset prices, which can result in increased losses during a market uptrend. Abraxas has faced significant unrealized losses of about $14.5 million from its short positions due to the recent rise in BTC prices. These losses are unrealized and could decrease if prices fall but may result in margin call risks if the uptrend continues.

The current losses are closely tied to the reversal in Bitcoin prices. The repeal of the U.S. IRS’s DeFi broker regulations in April 2025, the expansion of Bitcoin spot ETF approvals, and the pro-cryptocurrency stance of the Trump administration have all driven strong buying sentiment towards Bitcoin. Some data indicates that the inflow of institutional funds worth $1 billion can lead to a 3% to 6% increase in BTC prices. These policy and supply-demand factors run counter to Abraxas’s short position strategy.

Abraxas Capital holds short positions in key cryptocurrencies like BTC, ETH, SOL, and SUI, totaling approximately $500 million. About $380 million of this is concentrated in BTC and ETH, linked with high-risk strategies involving tenfold leverage. Their strategy includes predicting short-term price drops and maintaining fixed positions, making them vulnerable to rapid loss expansions during market rebounds.

Unrealized losses are potential losses from positions that have not yet been liquidated. If these accumulate beyond a certain level, they can lead to additional collateral requirements (margin calls), forced liquidation, or funding pressures. In fact, Abraxas previously recorded unrealized losses of about $25 million in May 2025. The accumulation of current losses could result in increased costs for maintaining leveraged positions, liquidity constraints, and decreased investor confidence.

This case highlights the nature of the cryptocurrency market. While high returns are possible, poorly timed high-leverage positions can lead to significant losses. Without deep analysis of policy changes, institutional fund flows, and the global macro environment, short strategies in cryptocurrency can be extremely risky.