Is Bitcoin Entering a Bear Market? Hidden Signals to Know

Why is Bitcoin’s price dropping below $94,000 significant?

What does the Head and Shoulders pattern mean for Bitcoin’s future price?

How could Trump’s regulations and the Fed’s policies affect Bitcoin?

- Bitcoin's price is below $94,000, with bearish sentiment, but it's neither overbought nor oversold

- Bitcoin's long-term outlook depends on Trump administration regulations and Fed policies

Bitcoin's price has fallen below $94,000, down from its all-time high of $108,000 recorded on December 17, 2024. According to data from CoinMarketCap, Bitcoin has dropped approximately 1.29% in the last 24 hours and 2.67% over the past seven days.Bitcoin is trading below its 20-day exponential moving average (EMA) and approaching the 50-day EMA. This indicates that Bitcoin's price is consolidating between $92,000 and $99,000. However, Bitcoin's price has remained above its 200-day EMA since October 2024. The current Relative Strength Index (RSI) is at 42, suggesting that the digital asset is neither overbought nor oversold.

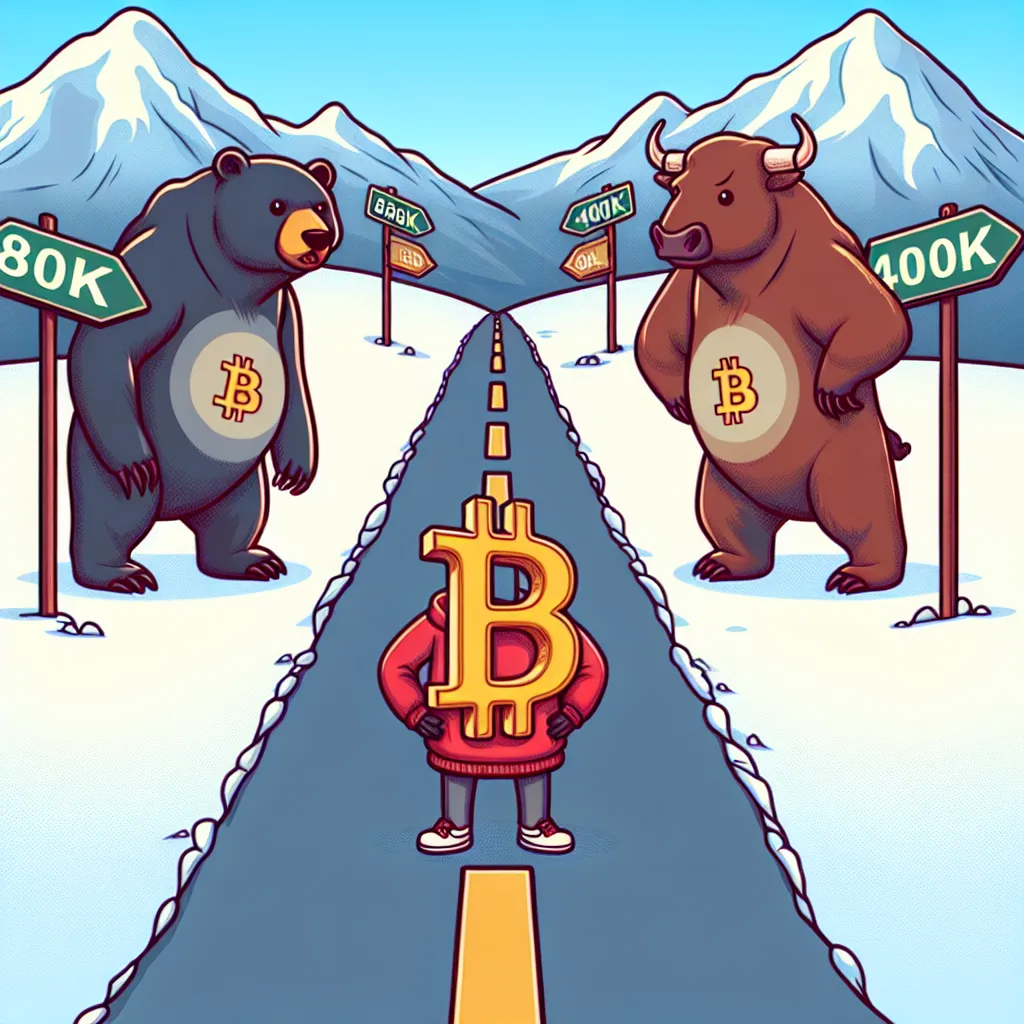

Recently, Bitcoin's Taker-Buy-Sell-Ratio fell to 0.92. When this metric is below 1, it signals that bears are dominating the market. Conversely, a ratio above 1 indicates that bulls are in control. The current value of 0.92 reflects a bearish sentiment in the market. TradingView contributor "The ForexX Mindset" warned that the growing dominance of Tether (USDt) in the market could drive Bitcoin's price down to approximately $81,500. This trend indicates that investors are moving to Tether as a safe haven, seeking refuge from riskier assets. Technical analyst Aksel Kibar predicted that Bitcoin's price might correct to around $80,000 based on a classic "Head and Shoulders" chart pattern. This pattern is widely regarded as a signal of potential price declines.

Despite these bearish indicators, the funding rates for Bitcoin perpetual futures contracts remain positive. Positive funding rates indicate that traders holding long positions are dominating the market and are willing to pay short traders to maintain their positions. Bitcoin's long-term price outlook largely depends on the regulatory stance of the incoming Trump administration and the Federal Reserve's monetary policy in 2025. The Trump administration's regulatory changes could introduce market volatility, while the Federal Reserve's monetary policy is a critical factor in determining asset values. Changes in interest rates by the Federal Reserve could directly affect market liquidity, impacting the prices of risk assets like Bitcoin.

This uncertainty has led to a wide range of predictions for the future price of decentralized digital assets. For example, cryptocurrency mining company Blockware recently forecasted that Bitcoin's price could range between $150,000 and $400,000 in the new year.

Get real-time crypto breaking news on Unblock Media Telegram! (Click)