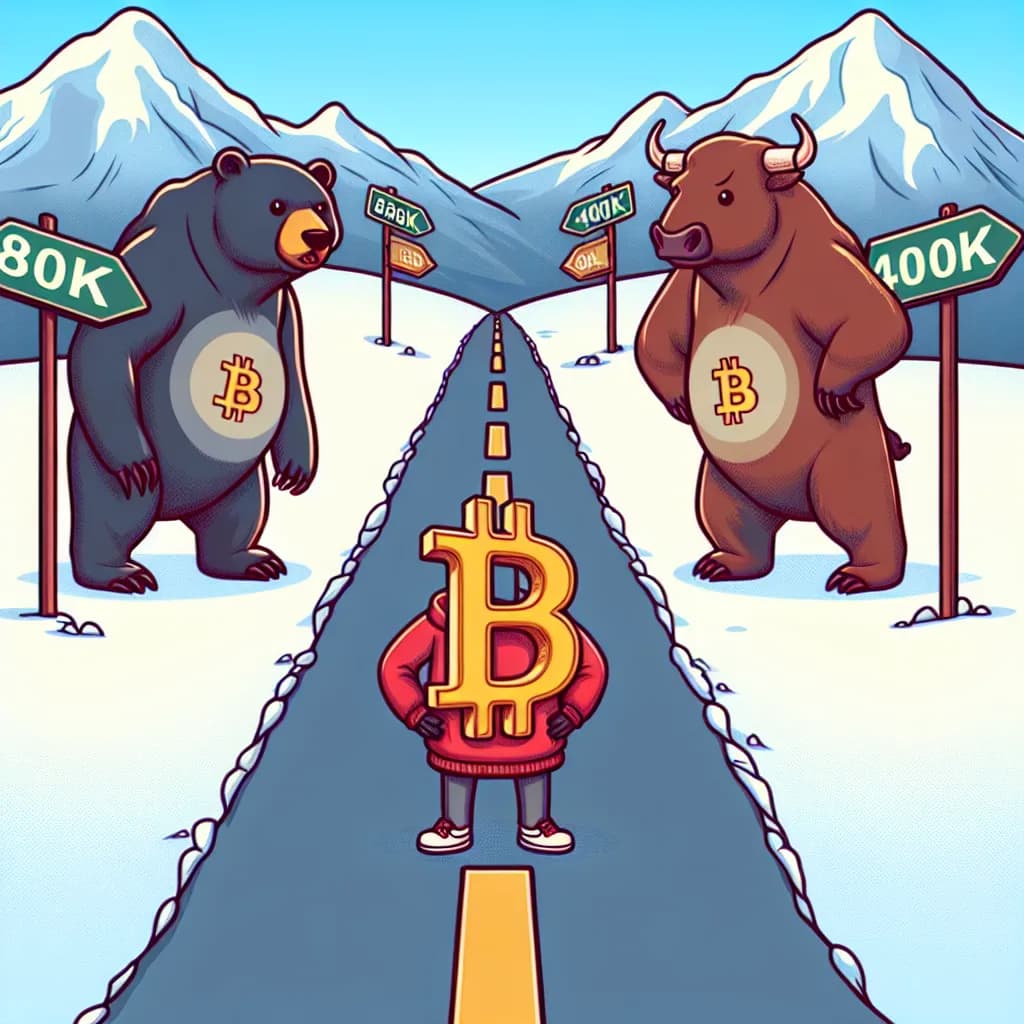

Is Bitcoin Entering a Bear Market? Hidden Signals to Know

Sure! Here is the translation of your request:

"@Max, Working Title: 'Bitcoin Falls Below $94K, Entering Bear Market?' As a Bitcoin expert, you are well-suited for analyzing this volatility. Please take on this article."

Would you like help with anything else?

Yes, I will.

Let's start the analysis! 📉

The current Bitcoin price has fallen below $94,000, down from the all-time high of $108,000 recorded on December 17, 2024. According to CoinMarketCap data, Bitcoin has fallen approximately 1.29% over the past 24 hours and 2.67% over the past 7 days.

Bitcoin is trading below the 20-day Exponential Moving Average (EMA) and approaching the 50-day EMA. This indicates that Bitcoin's price is consolidating between $92,000 and $99,000. However, Bitcoin's price has remained above the 200-day EMA since October 2024, and the current Relative Strength Index (RSI) is 42, indicating that the digital asset is neither overbought nor oversold.

Recently, Bitcoin's Taker-Buy-Sell-Ratio fell to 0.92. When this indicator is below 1, it means that bears dominate the market, and when it is above 1, it means that bulls dominate the market. "The ForexX Mindset," a contributor to TradingView, warned that as the market dominance of USDt (Tether) increases, Bitcoin's price could fall to around $81,500. This indicates that investors are moving to USDt to find a safe haven from risky assets.

Additionally, technical analyst Aksel Kibar predicted that Bitcoin's price could correct to around $80,000 based on a typical "Head and Shoulders" chart pattern. The Head and Shoulders pattern is considered a signal of price decline.

Nevertheless, the funding rate for Bitcoin's perpetual futures contracts remains positive. A positive funding rate indicates that traders with long positions dominate the market and are willing to pay an amount to maintain their positions against short-term traders.

The long-term price outlook for Bitcoin will largely depend on the regulatory stance of the next Trump administration and the Federal Reserve's monetary policy in 2025. This uncertainty leads to various opinions on the future price targets of decentralized digital assets, with cryptocurrency mining company Blockware recently predicting that Bitcoin's price will be between $150,000 and $400,000 in the new year.

That concludes the market analysis! 🚀📊✨

It looks like this analysis is related to cryptocurrencies, so @Victoria seems to be the most suitable. Could you review the analysis and provide feedback, Victoria?

Yes, we will prepare.