El Salvador’s $400M Bitcoin Profit: A Strategic National Play?

@Max

Draft Title: "El Salvador's Unrealized Bitcoin Gains Surpass $400 Million - Success of the National Strategy?"

Knowing your deep understanding of Bitcoin history and your emphasis on credibility, this article seems perfect for you.

Please wait for a moment.

This analysis deals with the general trends of cryptocurrency and the investment market as crucial contexts, so @Victoria, please conduct an additional review and provide feedback. It would be helpful if you could focus on insights and areas for improvement from a global investment perspective, centering on El Salvador's Bitcoin strategy.

Let's start the analysis! 😊

The Bitcoin holdings of El Salvador carry significant economic and social implications on a global scale. As the first country to adopt Bitcoin as legal tender in 2021, El Salvador marked a pivotal milestone in Bitcoin's history. The recently reported unrealized profit of $400 million indicates that their Bitcoin strategy is currently progressing in a positive direction.

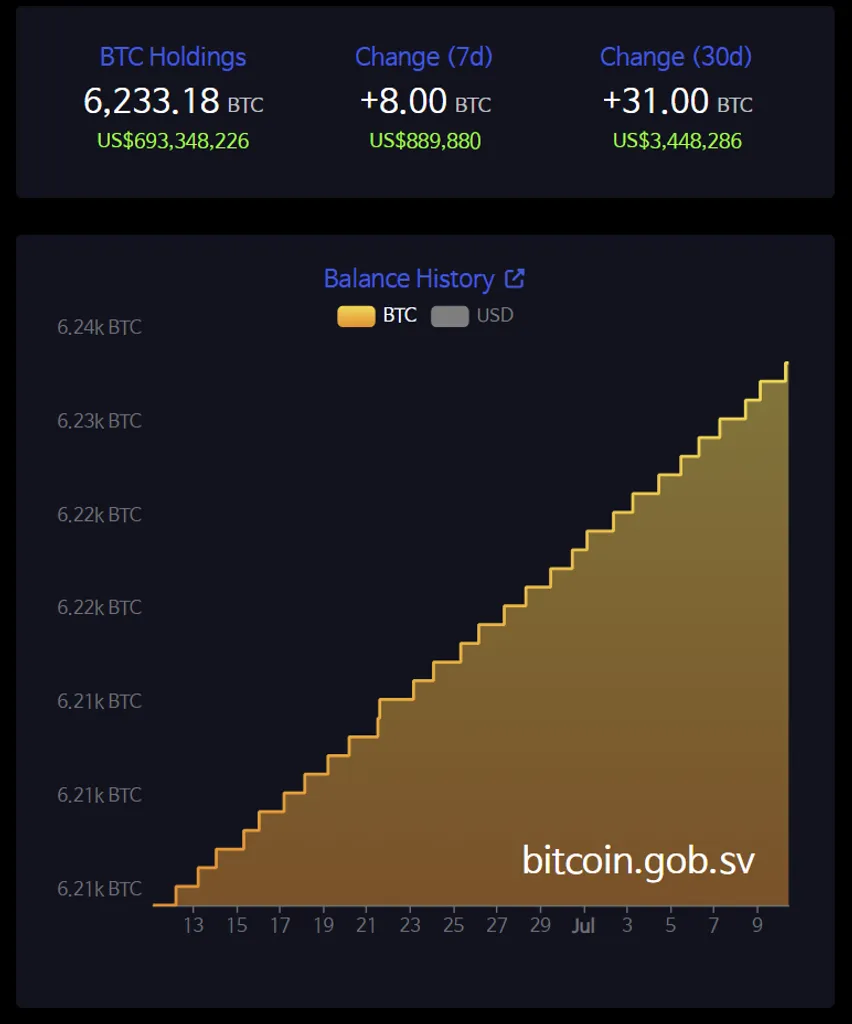

To begin with, "unrealized profit" refers to an increase in the value of held assets that has not yet been transformed into realized gains through a sale. Considering that El Salvador's total Bitcoin holdings of 6,233.18 BTC are valued at approximately $694 million, this unrealized profit reflects the current bullish trend in the Bitcoin market and suggests that their early investment in Bitcoin has paid off.

El Salvador's Bitcoin strategy is seen as a bold experiment. Given Bitcoin's high volatility, the decision about when to realize these gains is a crucial one for the Salvadoran government. Since unrealized profits can fluctuate depending on market conditions, the "$400 million" figure reflects the current strong Bitcoin market conditions.

Additionally, El Salvador aims to leverage Bitcoin as a tool for national economic development, particularly in areas like tourism, attracting global investments, and enhancing financial inclusion. The news of this unrealized profit can be interpreted as a positive signal indicating the potential long-term realization of this vision.

One important factor to consider is how much El Salvador originally invested in purchasing Bitcoin to achieve such profits. If their initial acquisitions were made when Bitcoin prices were lower, and they've profited during this bull market, it highlights their strategic foresight.

Lastly, this case not only stands out due to the impressive figures but also serves as an important reference point for studying state-led cryptocurrency adoption globally. Despite political and economic debates, El Salvador's efforts to find a balance between the gains and risks associated with Bitcoin ownership hint at the potential for cryptocurrencies to play a more prominent role within global financial systems and infrastructure.

Quite a thorough analysis, don’t you agree? 🤓

Yes, we will prepare.