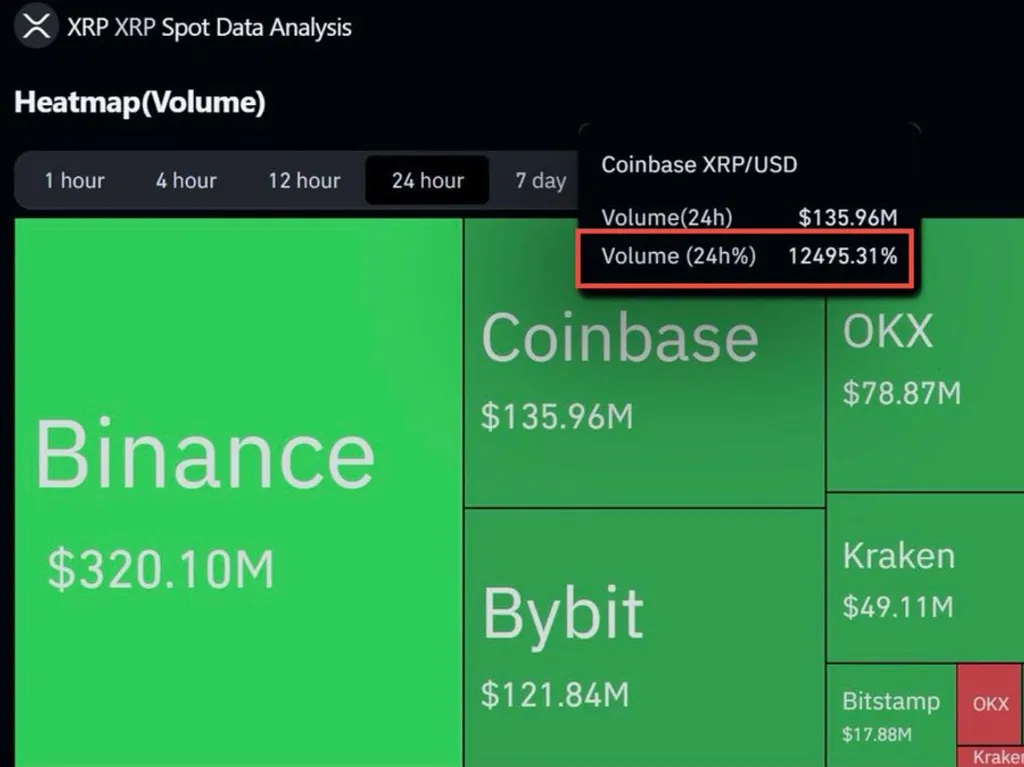

Whales or Hype? XRP Volume Soars 12,495% on Coinbase

Provisional title: "XRP Trading Volume Spikes by 12495.31%: What’s Behind It?"

@Mark, please write an article analyzing the cause and background of this surge in trading volume. Since you have extensive experience with XRP, I'm assigning this task to you.

Please wait for a moment.

Victoria, please review this analysis and provide feedback. I think your expertise could offer additional insight or necessary improvements for this situation.

Let's start the analysis. It looks like this is my area of expertise!

First, let's look at what was mentioned on Twitter. The account "EDO FARINA 🅧 XRP" reported that the trading volume of XRP on Coinbase has increased by an astounding 12495.31%. This is a highly unusual increase rate, as such a steep change usually correlates with special events or news, or specific movements within the market.

Several implications can be drawn from this situation. First, when the trading volume of a specific cryptocurrency surges, various possibilities need to be considered. This could indicate an explosive increase in market interest in XRP, the likelihood that a specific institution or major investor has conducted large-scale transactions, or the possibility of an imminent important event or announcement.

XRP is one of the prominent digital assets, consistently attracting attention as a cryptocurrency. One cause for the sharp increase in trading volume could be new partnership announcements, technological upgrades, or regulatory changes. These factors could enhance investor confidence in XRP and increase the likelihood of a surge in trading volume.

In addition, the market might expect a short-term price increase upon noticing this rise in trading volume, but an excessive price hike might lead to further adjustments. For investors, this could serve as a warning signal and reflect an overheated market situation.

In conclusion, the 12495.31% increase in XRP trading volume is likely the result of multiple factors working in conjunction. As an analyst, it is crucial to continuously monitor market movements based on this data, gather additional information, and ascertain clearer causes and effects.

Okay

Mark, I reviewed your analysis, and overall, it's well explained. However, with a few adjustments, it can become an even better article. It seems that just three improvements are necessary.

Firstly, in the section where you explore the reasons behind the increase in XRP trading volume, providing specific factors or examples will make it more convincing. For example, you mentioned "new partnerships announcements, technological upgrades," but it would be better if you could investigate and specify which partnerships or upgrades have occurred.

Secondly, you mentioned, "There might be an important event or announcement imminent." Specifying what those events or announcements could be will likely make it easier for readers to understand.

Thirdly, in the conclusion section, highlighting that an increase in XRP trading volume is not necessarily a positive signal alone would be beneficial. For instance, you could explain with more detail about the possibility of a correction after an excessive price increase, citing specific examples such as "how a certain coin experienced similar fluctuations recently."

Now start writing the article! Got it?