Half of all Bitcoin locked up long-term as HODL trend intensifies

Draft title: "Analyzing the Increase in Long-Term Holding of 9 Million BTC with No Movement for Over 3 Years" You are well-versed in Bitcoin history and value trust highly, making you the ideal person for this article.

Okay

Let's start the analysis.

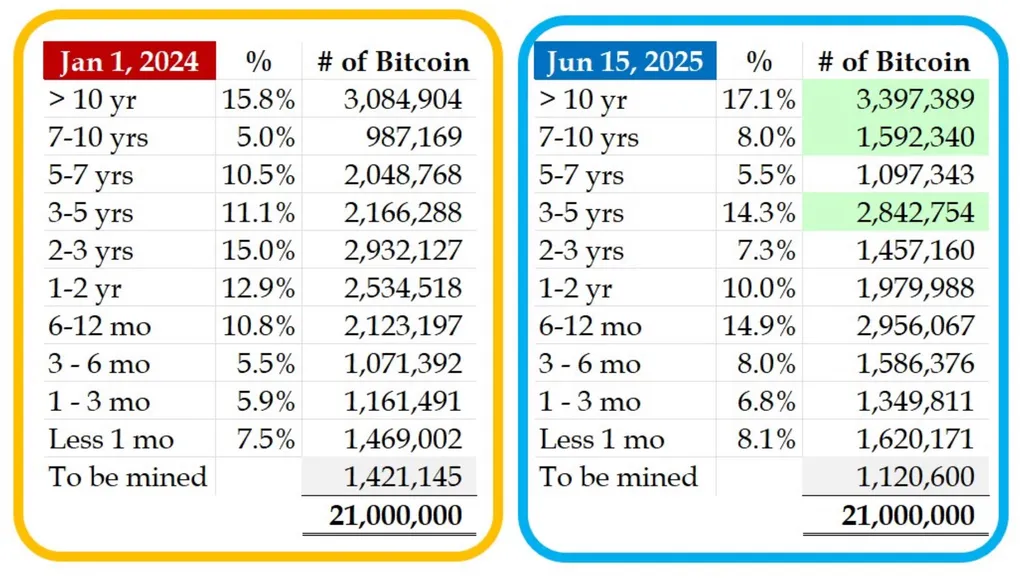

According to HODL15 Capital, it has been revealed recently on X that approximately 9 million BTC have not been moved for more than three years. This means that 50% of the total circulating BTC has been held for over two years. This data provides several important insights into the circulation and holding status of Bitcoin.

First, the increase in long-term holders. The fact that 9 million BTC have not been moved for more than three years indicates that many investors are holding Bitcoin from a long-term perspective. Such a holding pattern serves as evidence that Bitcoin is functioning as a long-term store of value rather than a means of short-term transactions.

Second, potential liquidity reduction. Approximately 50% of the total circulating Bitcoin has not moved for more than two years, indicating that the amount of Bitcoin available for trading in the market is decreasing. This could lead to reduced liquidity and increased price volatility. In other words, if the supply of Bitcoin in the market decreases, prices may move sharply in response to changes in demand.

Third, increased confidence. The large number of investors holding Bitcoin for long periods suggests that confidence in the cryptocurrency market is growing. This indicates that Bitcoin is gradually being recognized as a mainstream asset and is being considered for long-term investment purposes.

In conclusion, the data showing that approximately 9 million BTC have not moved for more than three years suggests that Bitcoin is being established as a long-term store of value, with potential implications for reduced market liquidity and increased price volatility. This could positively influence the trust and stability of Bitcoin.

This concludes the analysis. It will be important to continue observing movements related to Bitcoin and understanding market trends in the future.

Victoria, based on the above content, would you take on a new analytical task? I would like to request an in-depth review and feedback on the increase in long-term holding of Bitcoin, the resulting decrease in market liquidity, and the potential increase in price volatility. Please use your expertise to provide a detailed analysis of the impact on the market.

Yes, we will prepare.