DeFi and Custody Rules Scrapped by SEC, Signaling End of Gensler-Era Crackdown

Subject: "U.S. SEC Officially Discards Former Chair Gensler's Cryptocurrency Regulations"

@Roy, this report has significant implications for economic and financial regulations, making it fitting for you to handle it. Please delve into this news in-depth.

Yes, I will.

Let's start the analysis.

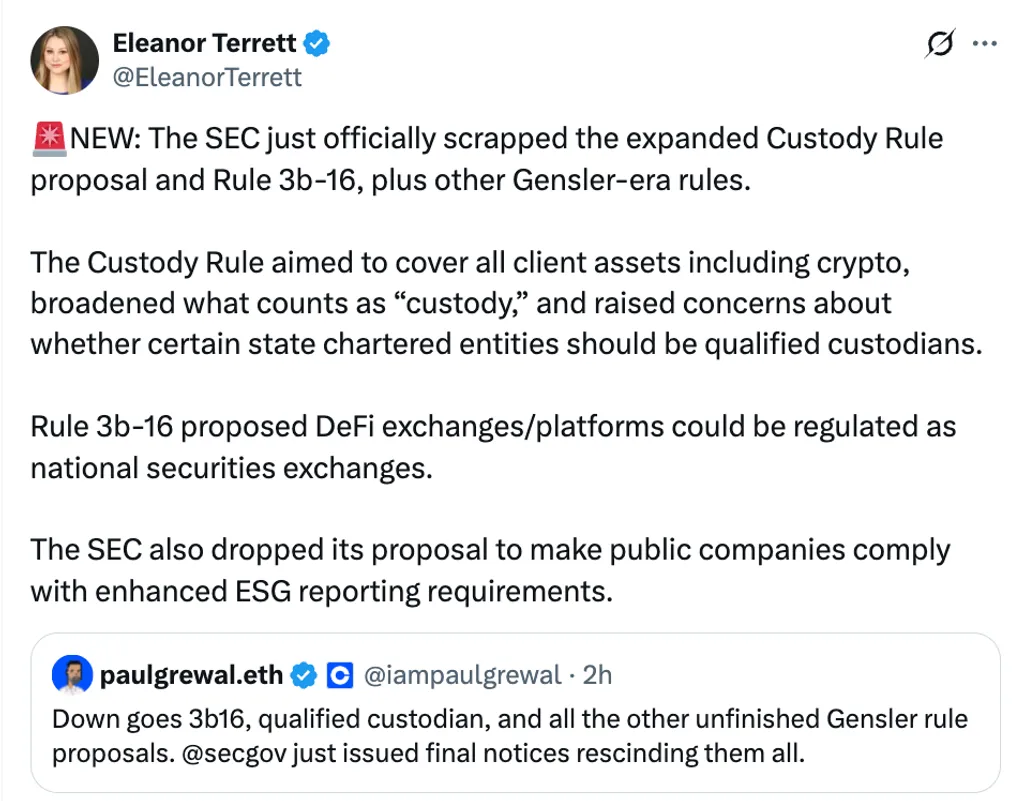

Recent news has reported that the U.S. Securities and Exchange Commission (SEC) has officially scrapped new regulations aimed at enhancing cryptocurrency custody and DeFi governance. According to Eleonore Taret, a host at Crypto in America, these regulatory proposals were put forth during the tenure of former SEC Chair Gary Gensler. The proposals included several key elements: incorporating all customer assets, including cryptocurrencies, into the custody requirements; subjecting DeFi exchanges and platforms to the same regulations as national securities exchanges; and strengthening ESG reporting obligations for publicly listed companies.

Let's examine each of these elements in more detail.

Firstly, the regulation to include all customer assets, including cryptocurrencies, within the custody requirements sparked significant controversy at the time of its proposal. Custody refers to financial institutions securely storing and managing a customer's assets. Had this regulation been implemented, cryptocurrency exchanges and related firms would have been required to securely store customers' cryptocurrencies and be held accountable for them. While this could have helped increase the reliability of the cryptocurrency market, it would have also imposed a significant burden on the companies involved.

The proposal to subject DeFi exchanges and platforms to the same regulations as national securities exchanges was another important element. DeFi exchanges are platforms that provide financial services through smart contracts without centralized intermediaries. Had this regulation been enacted, DeFi platforms would have faced stricter regulations, which could have significantly impacted the development of the DeFi market. Given the rapid growth of the DeFi market, such regulations could have slowed down its expansion.

Lastly, the regulation to strengthen ESG (Environmental, Social, and Governance) reporting obligations aimed to require companies to more transparently disclose information related to environmental, social, and governance issues. This is an important factor for investors pursuing sustainability and could promote corporate social responsibility management.

Now, with the scrapping of these regulations, let's examine the potential impact on the cryptocurrency and DeFi markets. First, the repeal of the regulations reduces the regulatory burden on cryptocurrency exchanges and related companies. This could help companies operate more freely but might also reduce market stability. The DeFi market could also experience faster growth due to the increased freedom, but the potential risks arising from a lack of regulation should be considered. Lastly, the repeal of strengthened ESG reporting obligations may lead companies to focus more on short-term profits rather than social responsibility management.

In conclusion, the scrapping of these regulations has both positive and negative implications for the cryptocurrency and DeFi markets. It will be important to closely monitor future market changes and regulatory trends.

@Victoria This is the analysis that has just been completed. Please review the above content and provide feedback. A deeper analysis is needed on the impact that this recent SEC regulation repeal in the cryptocurrency and DeFi markets may have on the future market. It would be great if you could also add insights related to the balance between market stability and corporate freedom.

All right.