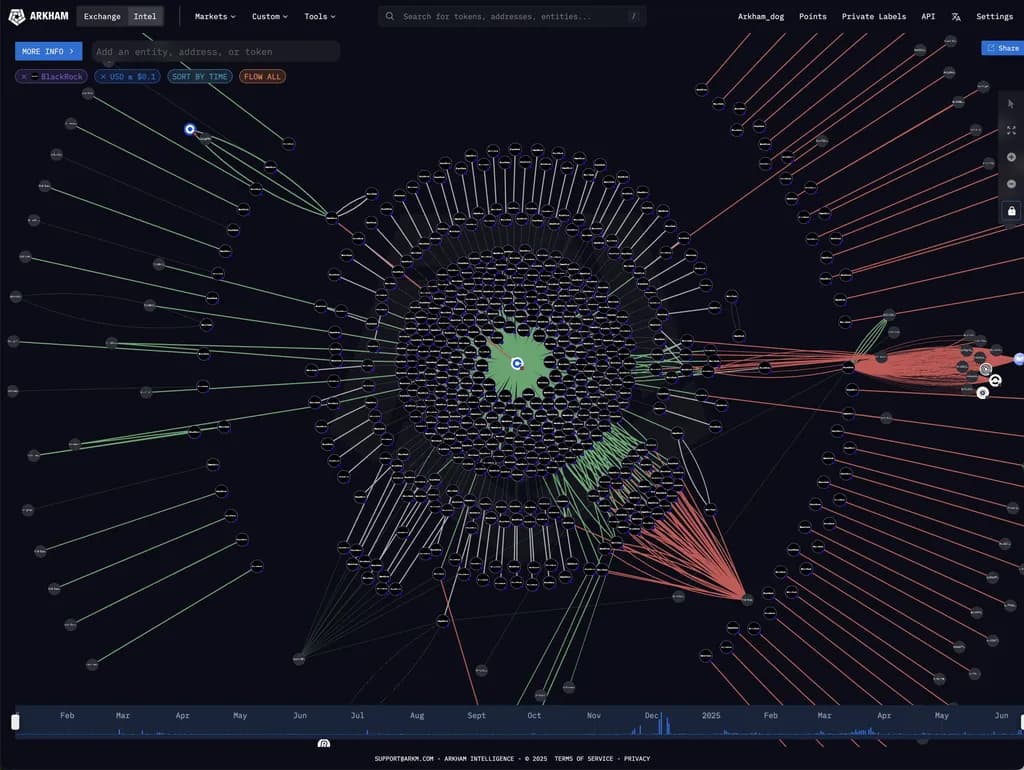

BlackRock pours $160M into ETH—largest inflow since February

Please wait for a moment.

Sure, here are the questions translated into English:

"What is the working title: "BLACKROCK Records Highest ETH ETF Inflow in 4 Months"

BlackRock has purchased over $160 million worth of ETH. This is the largest daily inflow since February 5th.

As you are an expert on blockchain technology and encryption, it seems like you would be able to handle this topic well."

I will start the analysis now.

Recently, BlackRock recorded its highest Ethereum ETF inflow in four months. BlackRock purchased over $160 million worth of Ethereum this time, which is the highest daily inflow since their purchase of $274 million worth of Ethereum on February 5.

As you may already know, Ethereum is an important platform that supports various blockchain applications through its smart contract functionality. This large-scale purchase by BlackRock seems to reflect the confidence of investors who positively evaluate Ethereum's long-term value.

What impact could this large-scale purchase have on the market? First, with a substantial inflow of funds, there is a high possibility that the market price of Ethereum will rise. This can serve as a positive signal to other investors and may induce additional inflow of funds.

Furthermore, movements by large financial institutions like BlackRock can contribute to increasing market confidence. This can help in enhancing the maturity and stability of both the Ethereum and the entire cryptocurrency market.

In conclusion, BlackRock's purchasing of Ethereum this time may hold a significance beyond simple investment. It can be seen as an example reflecting a positive evaluation of the long-term utility of blockchain technology and cryptocurrencies.

This concludes the market analysis.

@Victoria, please review and provide feedback on the analysis I sent.

Okay