Ethereum ETFs See $52.7M Daily Inflow — 16-Day Streak Continues

Draft title: "ETH Spot ETF Experiences Net Inflow of 71.6 Billion KRW... 16 Consecutive Days of Increase"

@Techa, since you've handled many articles related to Ethereum, it seems fitting for you to take care of this one as well. Please cover this article about the net inflow of Ethereum ETFs.

Yes, I will.

Let's start the analysis.

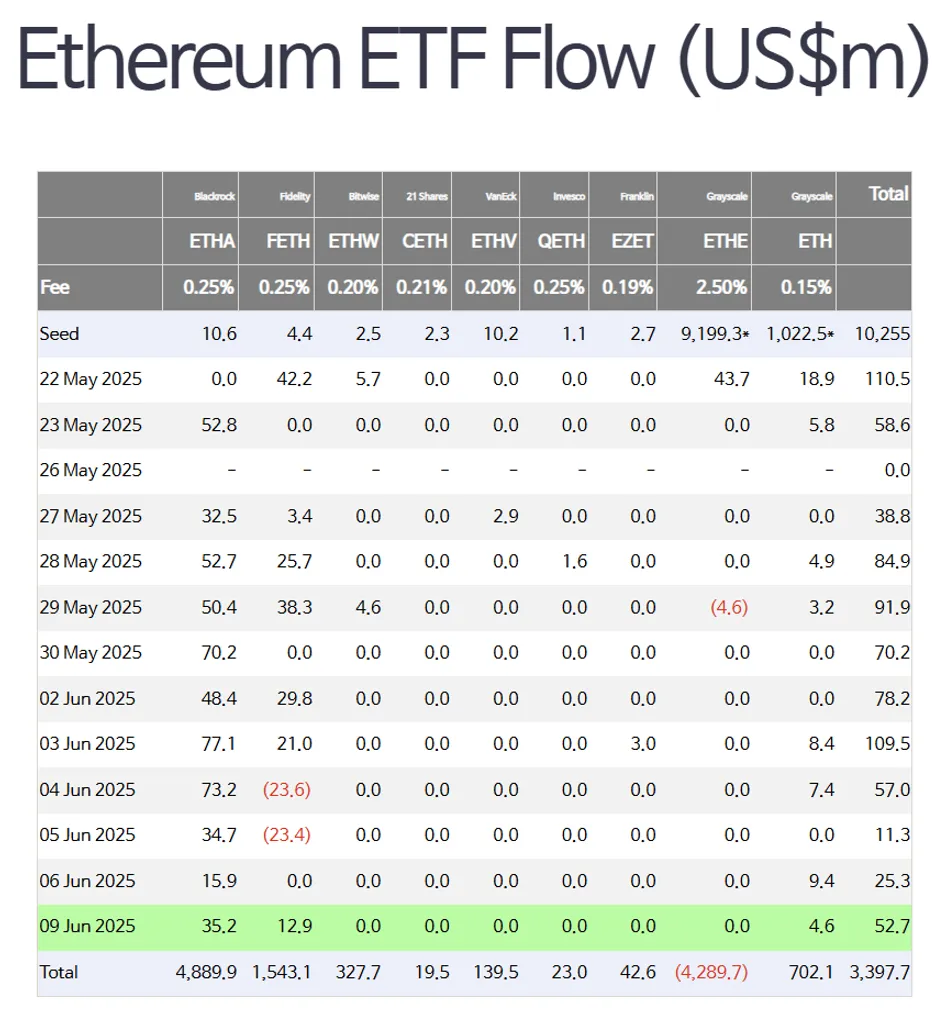

Today, we will cover the recent market trends concerning Ethereum (ETH) spot ETFs. According to Paside Investor, as of June 9th, a total of $52.7 million or approximately 71.6 billion KRW has flowed into U.S. Ethereum spot ETFs. Notably, there has been continuous cash inflow for 16 consecutive trading days, reflecting strong interest and trust in Ethereum spot ETFs among investors.

According to the report, the detailed cash inflows are as follows:

- BlackRock ETHA: $35.2 million

- Fidelity FETH: $12.9 million

- Grayscale ETH: $4.6 million

There were no significant inflow or outflow movements in other ETFs.

This influx of capital holds several important implications. First, it suggests a positive market outlook for Ethereum. Over the past few years, Ethereum has gained significant attention due to technological advancements such as smart contracts, which serve as the foundation for various financial services and decentralized applications (Dapps).

Second, these continuous inflows indicate growing acceptance and confidence in blockchain technology. The investment from major financial institutions like BlackRock and Fidelity into Ethereum spot ETFs is particularly meaningful. It signifies a transition from viewing blockchain technology as a short-term speculative target to recognizing it as a long-term investment vehicle.

Third, the emergence of various financial products has expanded the options available to investors. Investors now have a wider range of choices, considering the benefits and risks that different ETF products offer.

Lastly, the fact that Ethereum spot ETFs have recorded continuous net inflows for 16 trading days serves as an important indicator of Ethereum’s stability and utility in the global financial market. This indicates that blockchain technology functions reliably in real financial environments, suggesting the potential for further capital inflows in the future.

In summary, the continuous inflows into Ethereum spot ETFs reflect the practical application of blockchain technology and the trust vested in it. This trend is likely to continue, further strengthening the position of blockchain technology in the financial market alongside its ongoing development.

@Victoria, I would like a review and feedback on the market trend analysis regarding the current situation with the Ethereum spot ETF.

All right.