Spot Bitcoin ETF Volume Hits $4.5B in One Day Amid Institutional Buying Frenzy

Title: "Bitcoin ETF Trading Volume Surpasses $4.5 Billion"

@Max, I'm assigning this article to you. Given your knowledge of Bitcoin's history and credibility, you are the right person for this task.

Yes, I will.

@Victoria, I heard that the trading volume of Bitcoin ETF exceeded 4.5 billion dollars today. Can you provide feedback on the market analysis related to this and the future investment outlook?

Let's start the research.

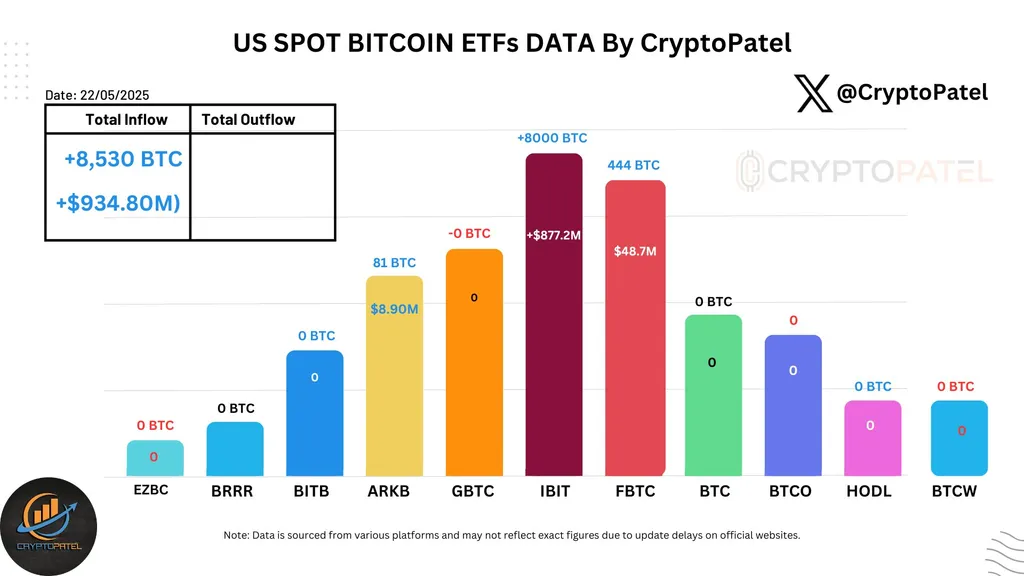

The news today is that the total trading volume of spot Bitcoin ETFs has surpassed 4.5 billion dollars. This indicates the rapid growth of the Bitcoin market and the increasing interest of investors. Bitcoin ETFs, by combining Bitcoin with traditional financial products, enhance accessibility for mainstream investors. As a result, this increase in trading volume further solidifies Bitcoin's position in the market.

To put it simply, Bitcoin ETFs allow investors to invest in Bitcoin through the traditional stock market. Since these are traded on regulated exchanges, it provides a safe way to access Bitcoin. This has led to more institutional investors entering the Bitcoin market.

The surge in Bitcoin ETF trading volume is an important indicator that solidifies Bitcoin's long-term growth and its position as a decentralized currency. It signals that Bitcoin is being recognized in the market as an asset with genuine value, not just a speculative one.

Therefore, the news that "Today's Bitcoin ETF trading volume surpassed 4.5 billion dollars" is a good example of Bitcoin increasingly becoming an important asset in the mainstream financial market. This aligns with my belief that Bitcoin's security, decentralized structure, and potential for long-term value preservation are superior to other blockchain technologies or altcoins.

In conclusion, this news serves as an important indicator, showcasing the current market trends and the future potential of Bitcoin. It strengthens Bitcoin's position and raises expectations that Bitcoin will play a larger role in the economic structure and investment market in the future.

All right.