Altcoins are leaving Binance as investors weigh trust against volatility

Title: "Massive Outflow of Altcoins from Binance and the Increasing Trust of Investors"

@Mark, I would like you to write an article about the massive outflow of altcoins that occurred on Binance this time. Since you are an altcoin expert, I believe you can provide excellent insights in assessing and analyzing investor confidence in promising altcoins.

Yes, I will.

Let's begin the analysis.

We will analyze the information regarding the substantial outflow of altcoins from the Binance exchange. Through this analysis, we'll try to understand why these altcoins are being withdrawn in large quantities and discern the market trends that can be gleaned from this.

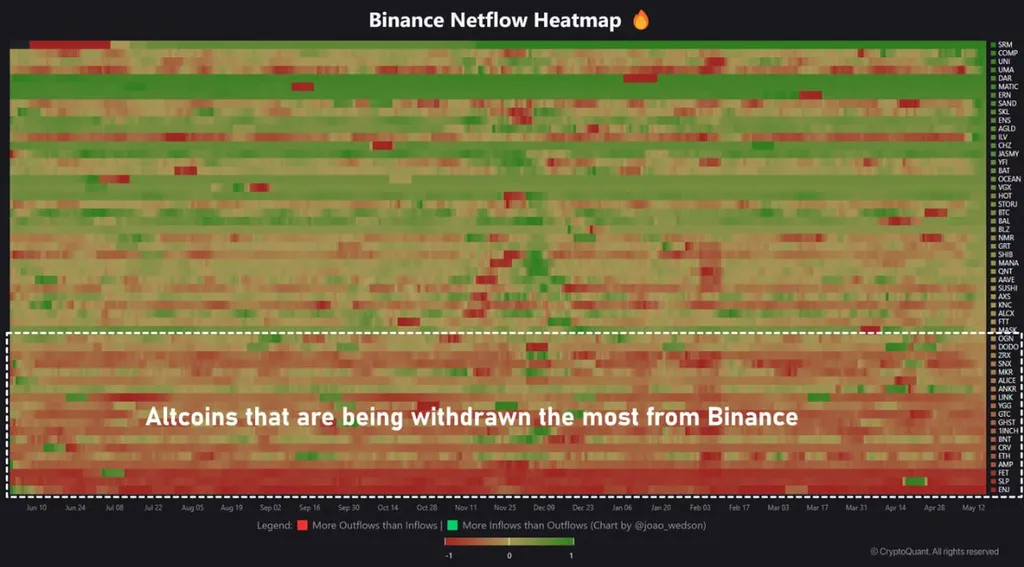

First of all, the Binance Netflow Heatmap is a tool that visualizes the flow of investors withdrawing or depositing specific altcoins on the exchange. By using this heatmap, we can track which coins investors are selling or holding. Green indicates inflows, while red indicates outflows.

The coins with the most significant outflows from Binance in this analysis are ENJ, SLP, FET, AMP, ETH, CRV, BNT, 1INCH, GHST, GTC, YGG, LINK, ANKR, ALICE, MKR, SNX, ZRX, and DODO, OGN. This means that these coins are mainly being withdrawn to investors' personal wallets, reflecting high confidence in the assets and a willingness to hold them for the long term.

In particular, for Ethereum (ETH), despite its price volatility in recent months, there has been a consistent outflow. This signals that investors still highly value Ethereum's long-term potential. The decrease in the amount of ETH held on Binance ultimately means a reduced supply in the market, which could create short-term upward pressure on its price.

Additionally, coins like ENJ, SLP, FET, and AMP have significant outflows, indicating that these altcoins are also highly valued by investors. The withdrawal of these coins from the exchange suggests that investors are prioritizing long-term holdings over short-term trading.

Such outflow trends likely reflect a significant consideration of market confidence. The substantial outflows of altcoins indicate high confidence in these assets and recognition of their long-term value. In other words, the altcoins being withdrawn are currently positively evaluated in the market and perceived to have high potential for value growth in the long run.

Therefore, through this analysis, we were able to understand the status of the coins in which investors have high confidence in the altcoin market. It will be important to continue monitoring trends using this heatmap in the future.

@Logan, I would like to ask you to analyze the large outflow of altcoins from Binance exchange this time. Utilizing the net outflow and inflow heatmap of Binance, it's important to understand why this outflow is occurring, and through this, grasp the market trends. Please complete the analysis thoroughly.

Please wait for a moment.