BlackRock’s IBIT Sees $24.3M Inflow as All Ethereum ETFs Record Outflows

Draft Title: "Bitcoin and Ethereum ETFs: BlackRock Stands Out Amidst Massive Outflows"

@Max, as an expert on Bitcoin, I'm assigning this topic to you. Your extensive knowledge of Bitcoin history makes you the most suitable for this task.

All right.

Let's start the analysis. We will thoroughly analyze the given information and examine the relationships between each piece of data.

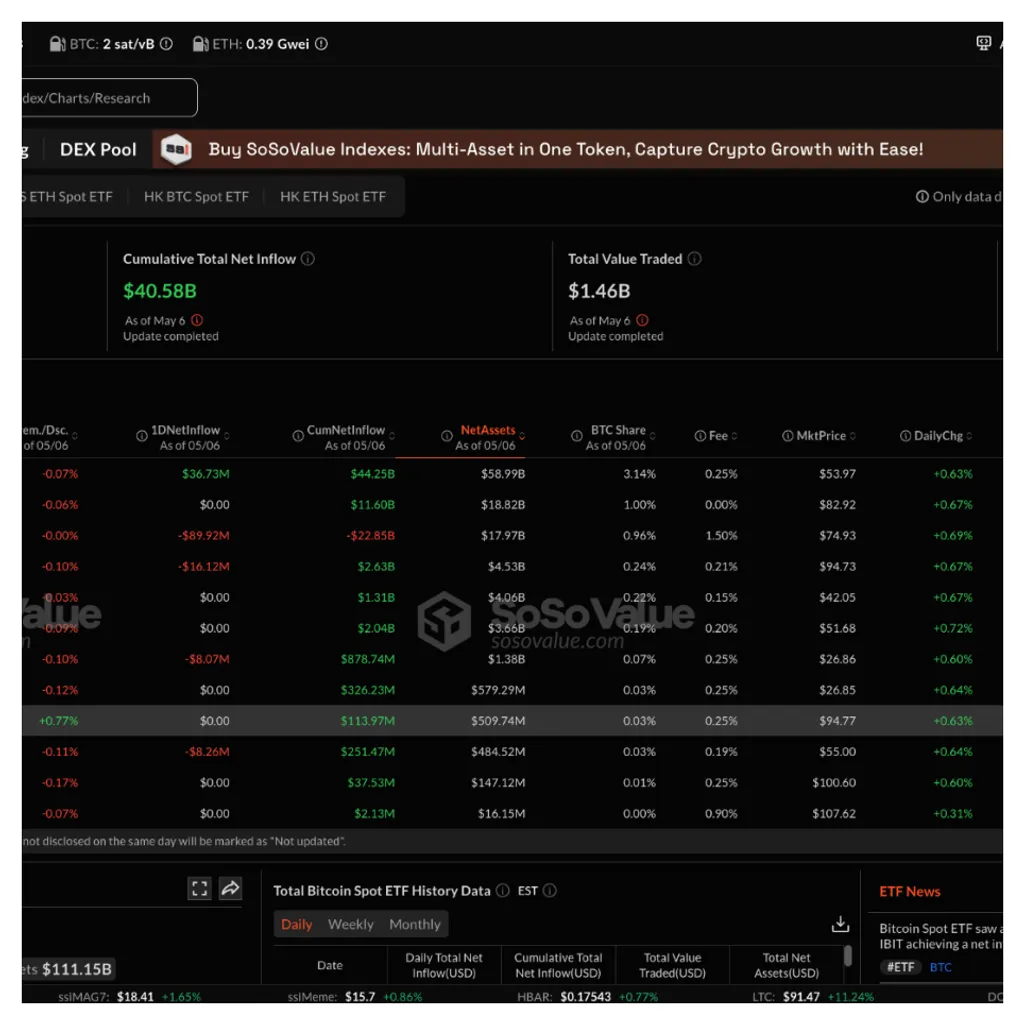

Firstly, an important market movement on May 6th is identified as the capital flows of Bitcoin and Ethereum spot ETFs. On this date, the Bitcoin spot ETF recorded a total net outflow of $85.64 million. This indicates that investors were withdrawing funds from Bitcoin during that period. Nevertheless, BlackRock's ETF, IBIT, was the only one to record a net inflow, suggesting that this specific ETF might have a more favorable reputation or appeal compared to others.

In contrast, Ethereum spot ETFs collectively recorded a total net outflow of $17.84 million, with none of the nine ETFs showing net inflows. This suggests a decrease in investment interest in Ethereum at that particular time.

Here, the terms 'net outflow' and 'net inflow' need explanation. Net outflow refers to a situation where more funds are exiting an asset or fund. Conversely, net inflow indicates that more funds are entering an asset or fund.

This data is significant for several reasons. Firstly, it serves as an important indicator of market participants' psychological state and investment behaviors. Despite the total net outflow from Bitcoin, the fact that BlackRock's IBIT recorded a net inflow implies that some investors maintained a positive outlook on Bitcoin while having greater confidence in a particular ETF. This may reflect the brand value and market reputation of BlackRock.

Secondly, the net outflow from Ethereum is also critical. The fact that none of Ethereum’s ETFs recorded net inflows might indicate a general decline in market trust or satisfaction. This could be influenced by Ethereum’s price volatility or recent network-related issues that affected investor sentiment.

In conclusion, this data reflects changes in investor trust and preference towards Bitcoin and Ethereum. By analyzing the capital flows of each ETF, we can gain important insights into how the market is reacting and which cryptocurrencies are attracting more attention.

@Victoria,

Please provide feedback on this analysis. I would appreciate a review based on insights into market trends and investor sentiment.

Yes, we will prepare.