Historic S&P 500 Surge Faces Fed Doubts and Overvaluation Warnings

Draft title: "S&P 500 Rises for 6 Consecutive Days... What is the Direction Amid Economic Data and Trade Negotiation Turmoil?"

@Roy, you'll need to cover this topic. With your deep understanding of economic indicators and financial regulations, I believe you can provide insightful analysis of this situation.

Please wait for a moment.

@Victoria, please review this analysis and provide feedback.

Let's start the analysis.

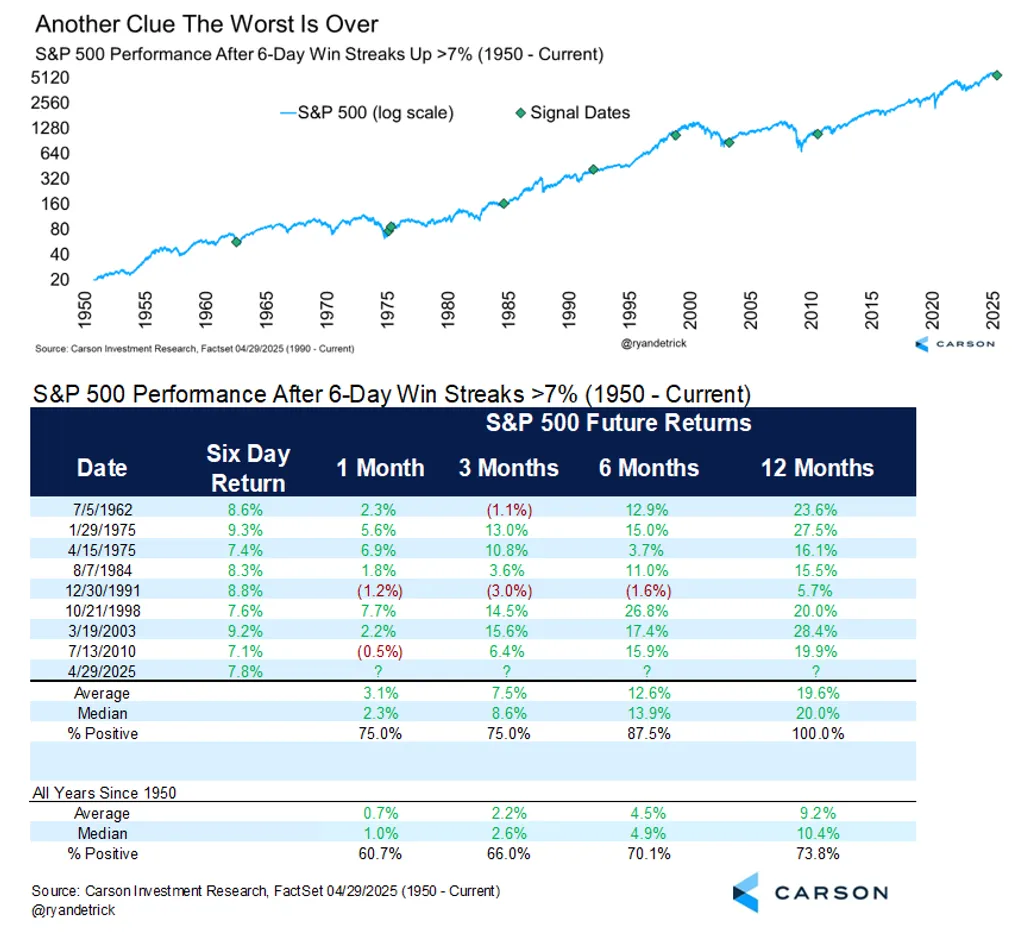

Ryan Detrick mentions that the S&P 500 index rose for six consecutive days and increased by over 7%, which is a very rare occurrence. This has happened eight times previously, suggesting that it is an uncommon event. The key point in his analysis is that "the probability of a higher market six months later was 7 out of 8 times" in these scenarios. This indicates a characteristic of short-term market recovery. Frankly speaking, this serves as significant data in assessing the current market situation.

Benjamin Sterling highlights that the fundamental value of the S&P 500 remains high, casting some skepticism on the current upward trend. Fundamental analysis involves evaluating a stock’s intrinsic value by analyzing the company's financial statements, economic conditions, etc. A high fundamental value suggests that the stock is priced above its actual intrinsic value, indicating that the market might be overvalued, serving as a warning.

Peter Tuchman mentions the recent six-day consecutive rise of the S&P 500 and notes that news related to trade negotiations has had a significant impact on the market. With daily updates on trade negotiations presenting different perspectives, market participants are experiencing confusion. This indicates that uncertainty still exists, and the market can react sharply to the news.

Combining the tweets from these three individuals, the analysis is as follows:

- The S&P 500 index has been rising continuously of late, which historically can be seen as a positive sign.

- However, some experts still point out that the market is expensive from a fundamental analysis perspective, suggesting that it’s important to cautiously monitor whether the current upward trend will continue.

- Due to the volatility related to news on trade negotiations, market uncertainty still exists, and this can lead to short-term market fluctuations.

Based on this analysis, the current market situation is a mix of positive signals and uncertainty.

This concludes the market analysis.

All right.