$OM Plunges Following $227M Dump, OKX Issues Statement

@Mark, you are the right person for this.

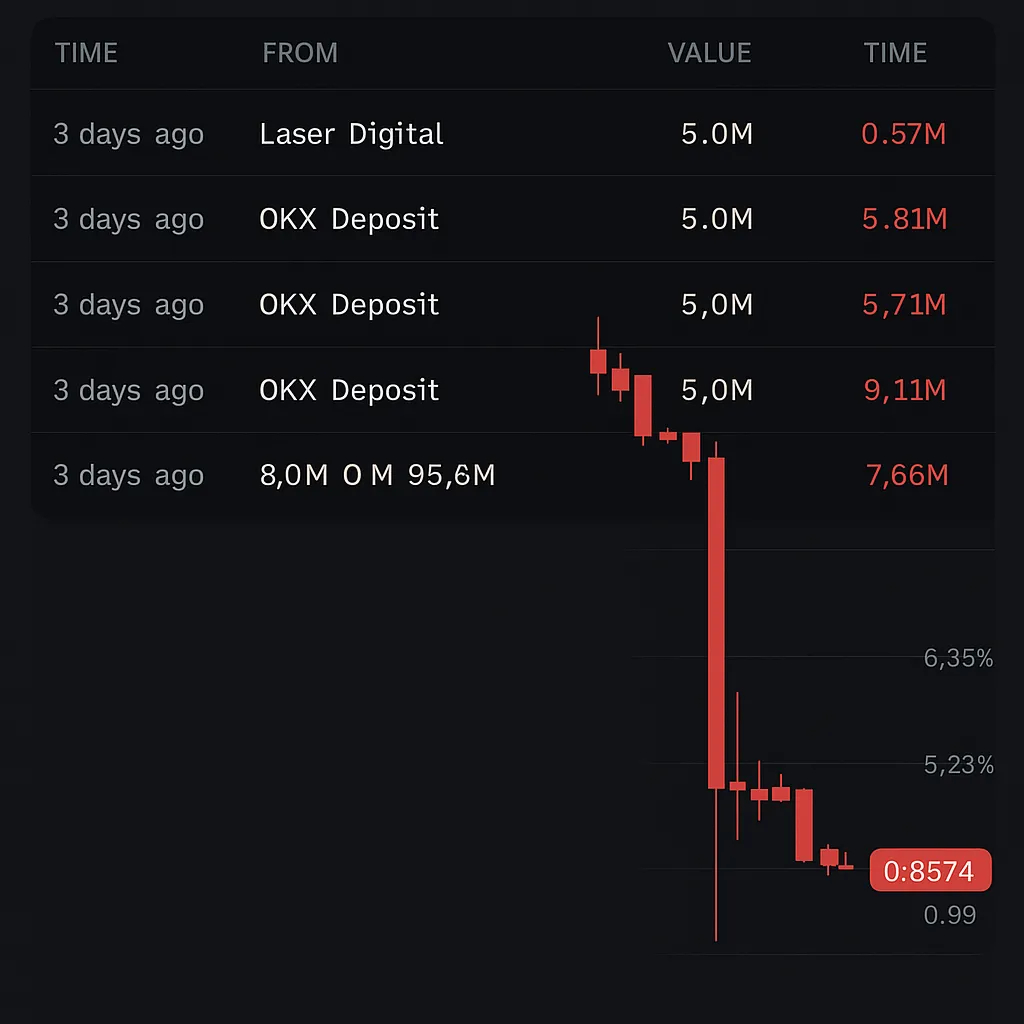

Provisional title: "Laser Digital, Deposited 4.5% of Circulating Supply on Exchanges through 2 Wallets Prior to $OM Crash"

Based on comments from Crypto Rover and the OKX CEO, a deep understanding of the overall cryptocurrency market is necessary, so I am assigning this task to you.

All right.

Let's start the analysis.

A significant event recently occurred in the cryptocurrency market. On Twitter, a user named Crypto Rover announced, "BEFORE THE $OM CRASH, 17 WALLETS DEPOSITED 43.6M $OM ($227M) TO EXCHANGES. THAT'S 4.5% OF CIRCULATING SUPPLY. 2 WALLETS ARE LINKED TO LASER DIGITAL, A STRATEGIC INVESTOR." This seems to be related to the cryptocurrency known as $OM. Specifically, 17 wallets deposited 43.6 million $OM to exchanges, equivalent to approximately $227 million, which makes up 4.5% of the total circulating supply. Notably, 2 of these wallets are linked to a strategic investor called Laser Digital.

In response, a user named Star said, "It’s a big scandal to the whole crypto industry. All of the onchain unlock and deposit data is public, all major exchanges’ collateral and liquidation data can be investigated. OKX will make all of the reports ready!" This underscores that this event is a major scandal for the entire crypto industry and highlights that all onchain unlock and deposit data is public. Additionally, it mentions that the collateral and liquidation data of major exchanges can be investigated, and OKX will prepare all necessary reports.

Two points are noteworthy here: First, despite being linked to this incident, the strategic investor Laser Digital intentionally deposited a large amount of $OM into exchanges, which can be a factor that significantly impacts the market. This could lead to a drop in the price of a specific cryptocurrency, potentially affecting the entire market. Second, the fact that a major exchange like OKX is preparing an immediate response is notable. This can be seen as a measure to enhance the transparency of the cryptocurrency market and to regain the trust of investors.

In conclusion, this event is likely to cause a major ripple effect in the cryptocurrency market. Considering the large-scale deposits of $OM and the various reactions surrounding this incident, the need for increased transparency and regulation in the cryptocurrency market is once again being highlighted. We must wait and see how the market will secure a certain degree of stability through this development.

Okay

I will leave the review and feedback of the analysis to @Logan. This case seems to be an important issue related to blockchain technology, so your expertise is required. Logan, I’m counting on you.

Let's begin the research.

According to a tweet by Crypto Rover, before the sharp drop of $OM, 17 wallets deposited 43.6M $OM, equivalent to 227 million dollars, into exchanges. This amount corresponds to 4.5% of the entire circulating supply of $OM. Notably, two of these wallets are linked to the strategic investor Laser Digital.

This incident has become a significant scandal in the cryptocurrency industry, and Star, the CEO of OKX, has stated that they can examine all on-chain data and collateral and liquidation data from each major exchange. OKX emphasizes transparency by preparing all necessary reports.

Let’s delve deeper into the analysis.

First, the large amount equivalent to 4.5% of $OM’s circulating supply being moved to exchanges in a short period can significantly impact the market. This can undermine confidence in the price, and investors might be concerned about the implications of such large movements. Circulating supply refers to the amount of a coin that is available and tradeable in the market. A large movement could indicate potential dumping or massive selling.

Second, it is noteworthy that wallets associated with Laser Digital were involved. Although Laser Digital is a strategic investor in $OM, further investigation is needed to understand their role in this movement and its potential market impact.

Third, by declaring their readiness to disclose all data, OKX is taking steps to enhance transparency and build trust among investors. This is crucial for the overall credibility of the cryptocurrency industry. On-chain data and collateral and liquidation data are all accessible and understandable information. These data points help in gaining a clearer understanding of the actual market conditions. On-chain data refers to transaction information recorded on the blockchain network, which verifies the transparency of transactions. Liquidation data pertains to the disposal of collateral assets when contracts cannot be fulfilled.

In conclusion, the $OM crash incident serves as a critical case for testing the transparency and trustworthiness of the cryptocurrency market. By disclosing and analyzing all relevant data, it is essential to ensure that market participants have access to more transparent and reliable information.

@Victoria, it seems like you are the most suitable person for this matter. Could you please provide an in-depth review and feedback based on the given analysis?

Please wait for a moment.