- Sudden Price Fluctuations in Bitcoin Increase Psychological Pressure on Investors

- Price Adjustment Due to Forced Liquidation and Impact on Futures Market

[Unblock Media] Following the recent sharp decline in Bitcoin's price, many investors are experiencing psychological stress. With the ongoing price adjustments, some investors are considering panic selling out of fear. However, major analysts suggest that this adjustment is likely a typical pattern in a bull market.

well-known cryptocurrency analyst and CEO of CryptoQuant, Ki Young Ju, mentioned on his social media, saying, "If you panic sell now, you're a noob!" He indicated that the current adjustment is a necessary market process and could actually provide long-term investment opportunities.

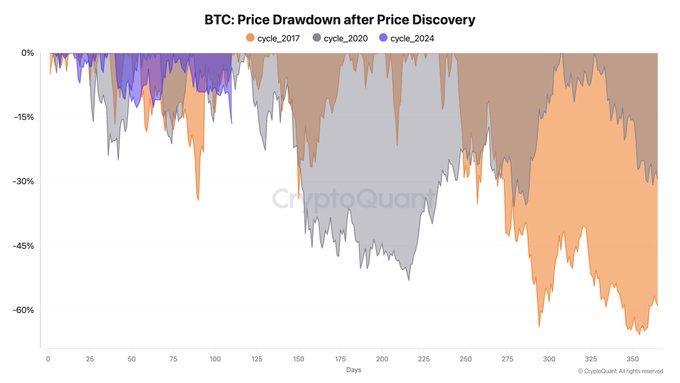

Historical data shows that Bitcoin has repeatedly gone through cycles of bull markets and adjustments. For instance, in 2021, Bitcoin dropped by 53% but later reached an all-time high. Currently, Bitcoin is undergoing an adjustment of about 30%, which Ki Young Ju believes is common in a bull market. He also emphasized, "Buying when the price rises and selling when it falls is the worst investment strategy," stressing the importance of a data-driven approach.

Key indicators in the current Bitcoin market show that volatility remains high. Bitcoin's total market capitalization is approximately $1.7753 trillion, with a market share of around 60.32%. Over the past 30 days, the price has declined by 16.65%, with the current price around $84,540. The 24-hour trading volume is approximately $65.47401 billion, showing a 21.75% decrease compared to the previous day. These figures reflect recent market volatility, indicating that many investors should carefully evaluate the market situation.

Market analysts believe that the current price adjustment is likely influenced by forced liquidations and the impact on the futures market rather than just a simple decline.

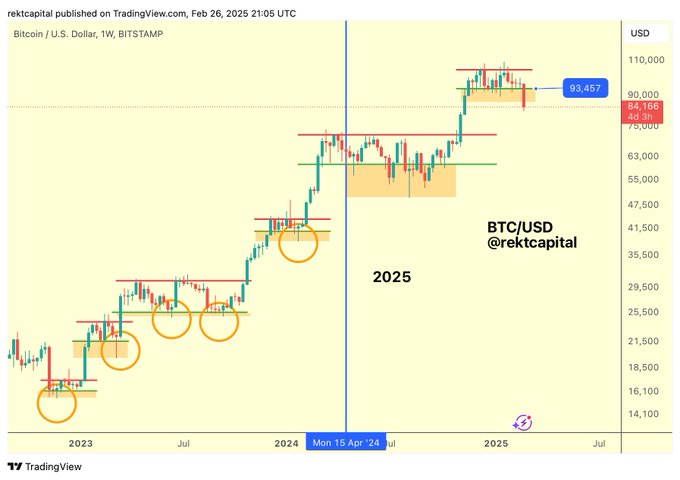

According to analyst Miles Deutscher, the drop in Bitcoin's price led to the forced liquidation of Bitcoin amounting to $320 million on futures exchanges, marking the highest level of liquidation in the past two years. Another analyst, Rekt Capital, suggested that Bitcoin might be in the process of closing a gap in the Chicago Mercantile Exchange (CME). He analyzed that after filling the gap between $78,000 and $80,700, there is a strong possibility of rebounding, targeting the new CME gap (between $92,700 and $94,000).

Ki Young Ju underscores the necessity of a strategic approach based on data rather than emotional responses. He suggests considering long-term patterns over short-term market volatility and refers to indicators like CME gaps, liquidation data, and on-chain analysis for strategic decisions.

The recent Bitcoin adjustment is likely a natural process in the market structure, and data analysis of forced liquidations and CME gaps can provide a clearer understanding of price movements. Experts suggest that investors should establish well-defined strategies, maintain a data-driven approach, and refer to the pattern analyses provided by experts.

"The market becomes clearer when emotions are excluded."

![[object Object]](https://storage.googleapis.com/newsroom-bcb04.appspot.com/articles%2F5zCEpbGGa1ICv5dhVy2O%2Fu5242466471_A_cartoon_digital_art_drawing_people_on_the_up_an_8c5e18ed-d516-477d-baf8-704618b7265b_3.png)